| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Fed’s Talk Of QE3 Is Dangerous

Fed risks inflation with talk of QE3

With the eurozone crisis threatening to pull down the US economy, some members of the Federal Reserve are discussing another round of quantitative easing.

We've got problems. A number of structural issues — from Europe's woes to the federal debt problem to stagnant job growth and still-falling home prices — will likely push the American economy dangerously close to a new recession in 2012.

We've got problems. A number of structural issues — from Europe's woes to the federal debt problem to stagnant job growth and still-falling home prices — will likely push the American economy dangerously close to a new recession in 2012.

Much of Europe and Asia are already there. Indeed, a coalition of Europe's major economic institutions said Wednesday that the eurozone is already in a recession.

It's probably not surprising, then, given the activist nature of our central bank, that the Federal Reserve — which is already in the midst of Operation Twist to pull down long-term interest rates and has committed to holding short-term rates near zero through 2013 — is starting to fidget. A chorus of officials have hit the speaking circuit over the past week, talking up the potential for more policy easing.

In simple terms: The Fed is laying the groundwork for another round of unmitigated money printing, also known as quantitative easing — or QE3, as it would be the third iteration of the strategy. If carried out, it would not only be a political blunder in an election year but it would do further damage to the economy.

Backing up a minute, there is evidence that, all else equal, quantitative easing is effective in bringing down interest rates and stimulating growth when the economy is on the ropes and inflation is fully at bay. This has a lot to do with the surprise factor or novelty effect.

Thus the success of the original QE1, which started back in late 2008 with the Fed's announcement that it would buy $600 billion worth of mortgage securities and mortgage debt. This was expanded in March 2009 to include U.S. government debt.

The second iteration, teased in late 2010 and launched that November, was decidedly less successful despite Wall Street's excitement over Fed chief Ben Bernanke's overt goal of pushing up the stock market as a way to boost economic growth despite the risks of higher inflation and dollar devaluation.

It didn't work.

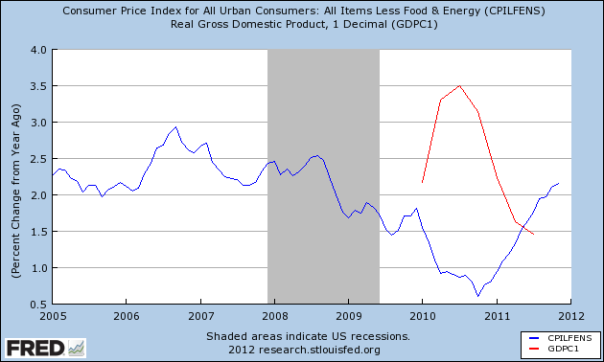

You can see this in the chart above. GDP growth peaked just before the Fed teased QE2 and plunged afterward as inflation spiked. The Fed's preferred core measure of inflation, which filters out fuel and food prices, jumped from nearly 0.5% to more than 2% in a smooth, steady upward trajectory.

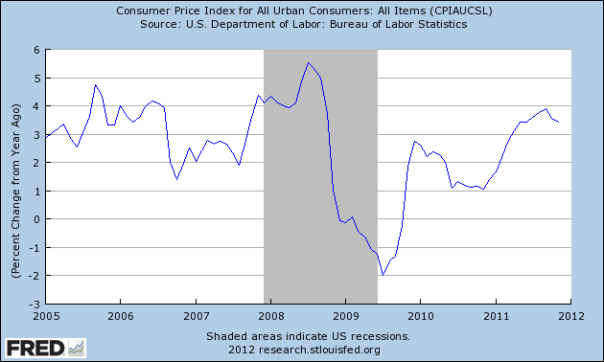

Headline inflation, which includes food and fuel, increased from 1% to nearly 4% a few months ago before pulling back slightly.

If this isn't an example of the "significant increases in inflation" Bernanke derided his critics for warning of in his November 2010 opinion piece in the Washington Post, I don't know what is.