| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

100 Years Of Success? – Fed ‘Inflation’ Style

Zero Hedge

Submitted by Tyler Durden on 12/26/2013

Money is only as useful as to what it can purchase. The Fed has created a system where debt is now equal to money. This is why big purchases like cars, housing, and even going to college are only feasible by mortgaging your future for many decades. Since the payments are broken down into tiny monthly installments many people pay little attention to the true cost of things over their lifetime. Yet, as MyBudget360 shows, over time, the U.S. dollar has lost a tremendous amount of purchasing power due to inflation. Inflation slowly eats away at your purchasing power yet having access to debt has given the middle class the false impression that they are still protected from the unraveling impacts of inflation. They are not…

As MyBudget360.com goes on to note,

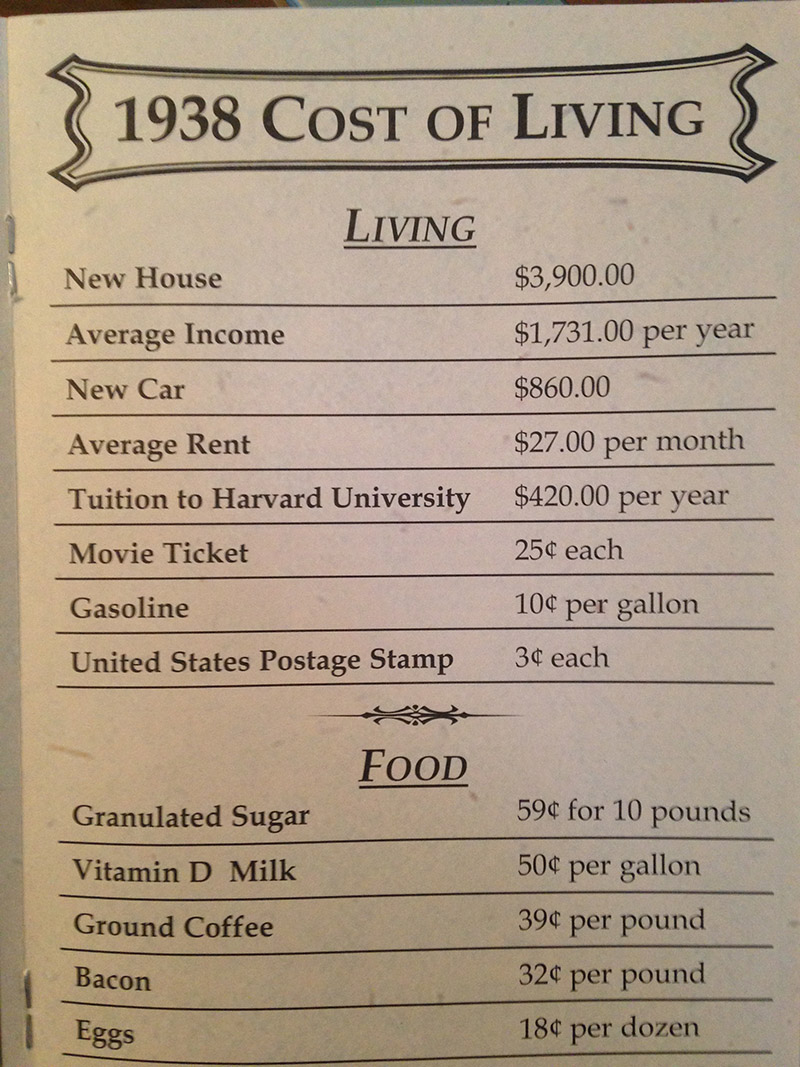

Someone sent over a photo posted over on the popular Reddit website that shows the cost of living for people back in 1938. You would think that people in 2013 would have more purchasing power than those living through the Great Depression. Adjusting for inflation you would be surprised what has happened in the last 75 years.

The cost of living between 1938 and 2013

The picture in question has prices for living from 1938. It includes important items like a new home, income, new car, rent, and extreme purchasing examples like tuition for Harvard:

Source: Reddit

You can normalize costs over time through adjusting for inflation. Back in 1938 a new home cost about two times the annual average income. A new car was only about one-third the cost of the annual average income. These figures are important because back in 1938, using credit was only a small factor in purchasing goods. The middle class didn’t start blossoming until after World War II so you would expect that things were still tough for regular households. What we find though is that compared to the typical income, buying a new home or buying a car was relatively doable for most households.

Now adjusting all these figures for inflation shows how much more expensive things have become and how dependent we now are to financing purchases with debt (created by the banking system):