| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Monday Market Movement – Can We Continue to Ignore and Soar?

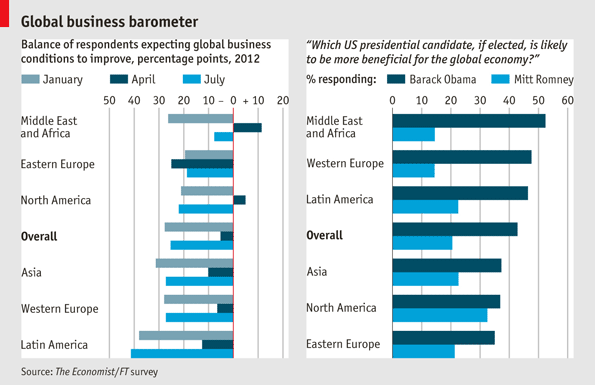

I found this chart interesting from the Economist:

I found this chart interesting from the Economist:

It shows, pretty CLEARLY that GLOBAL business sentiment has worsened sharply, according to the latest Economist/FT survey of over 1,500 senior executives. The balance of respondents who think the world economy will improve over those who think it will worsen fell from minus 5 percentage points in April to minus 25 in July.

Overall, 42% of executives now reckon business conditions will worsen. Most predicted, unsurprisingly, that Europe's biggest problem will be economic uncertainty. More than 60% believe economic conditions in the euro area will get worse in the next six months. The outlook for North America is more optimistic, though with a presidential election in November that could change. Barack Obama leads Mitt Romney in every region, and by 22 percentage points overall, on the question of which candidate would be better for the world economy. An Obama presidency is also considered better for business, with strongest support coming from those in government, education and health care, pharmaceuticals and biotechnology.

I did a lot of reading this weekend – looking for something to get bullish about but, other than the expectation of more stimulus (BECAUSE things are so bad) – I just can't find it. Even if we were to get enthusiastic about some sort of additional ECB stimulus AND QE3 – is that going to be enough to take us past America's fiscal cliff in 135 days or is 135 days just so far in the future that people simply are not going to worry about it? Clearly 135 days can seem like an eternity in a market where the average stock is held for 22 seconds.

I did a lot of reading this weekend – looking for something to get bullish about but, other than the expectation of more stimulus (BECAUSE things are so bad) – I just can't find it. Even if we were to get enthusiastic about some sort of additional ECB stimulus AND QE3 – is that going to be enough to take us past America's fiscal cliff in 135 days or is 135 days just so far in the future that people simply are not going to worry about it? Clearly 135 days can seem like an eternity in a market where the average stock is held for 22 seconds.

As you can see from Dave Fry's SPY chart, the volume has simply gone away in this rally and Barry Ritholtz wrote an article in the WaPo this weekend asking "Where has the Mom and Pop Retail Investor Gone?" When you consider that about 90% of the volume we do see is nothing more than HFT systems trading with each other (hence the 22 second average hold), then we may well wonder where the institutional investor is as well.

While $8.87Tn is on deposit in US banks, only $7.11Tn is on loan. That gap of $1.77Tn represents a 15% expansion since May. The only thing banks are doing with their money (which they get at…

2012-08-20 08:16:53

Source: http://www.philstockworld.com/2012/08/20/monday-market-movement-can-we-continue-to-ignore-and-soar/

Source: