| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Monday Stick Save

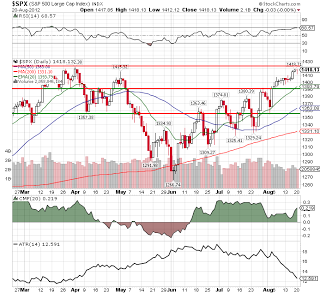

It should not come as a surprise that, after a bullish breakout, we again pause, and that is what we did today. We are just short of a new 2012 high on the SPX, and it may take a few days to build up the momentum to get there. Today we came back from the near dead and close almost exactly even, giving the bulls something to hang their hats on. ATR is dropping fast and is now at a level last seen since just after the market topped in April. Overall it looks like a cinch we will get to a new highs, probably sometime this week.

The Nasdaq’s next big hurdle is going to be the early May high, and if it gets past that, it might run into some hellish resistance between there and the 2012 high. With the Nasdaq lagging as badly as it has (the price relative line is now only at the level it was at in early July), the bulls have some life, but it may not last for long.

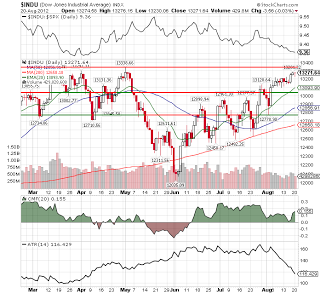

With the price relative dropping as fast on the Dow as it has been, I would have expected a hellacious rally. While we are in a decent up move, it is a lot weaker than it should be.

This is probably why. the Russell 2000 is just not reponding as positively as the rest of the market to this latest rally, and has performed pathetically since the June low. If this doesn’t get it into gear really fast, this rally won’t last much longer. I think mwe are pretty safe for the rest of this month, thanks to vacation season, but watch out for September.

I will have the new highs update shortly.

2012-08-20 20:08:39

Source: http://samuraitrader.blogspot.com/2012/08/monday-stick-save.html

Source: