| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

The ECB Solution

The ECB press conference is going on as I write this. However, does anyone think that the outcome of the latest ECB action will work? They have tried pretty much the exact same thing twice before, and failed.

As we look at the world economies, there is a lot of jockeying and machinations being used to stimulate everything. But they are missing two very key facts. One, they have no control over. The second they have absolute control over.

The solution to economic problems that the US Federal Reserve, Bank of England, Bank of Japan and the ECB and all their governments can be summed up in two phrases. Increase government spending, lower interest rates. These policies have failed miserably.

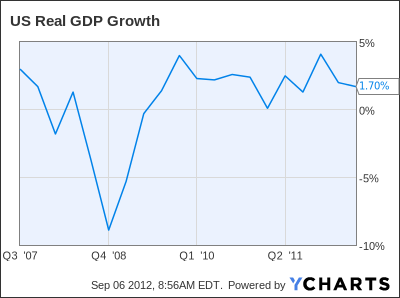

GDP growth is terrible. Typically, we target 3-4% in the US.

US Real GDP Growth data by YCharts

Because GDP growth is horrific, job growth is terrible and the debt explodes. There is only one way out of a deficit: cut spending and GROW.

All governments need to change their course right now and encourage growth policies. That’s not going to happen in Europe. It’s a stodgy place filled with rules, regulations, high taxes, big entitlements and high taxes.

In the US, we still have a chance. Our economy is much more dynamic than any other world economy. But, we can’t continue to spend at a 25% ratio to GDP. So, cutting spending is key to future economic health. The Democrats want to increase spending and double down on stimulus programs. The Republicans don’t cut spending fast enough.

In addition, taking the growth mechanism out of the government’s hands, government spending has a multiplier effect of 0, and putting it into the private sector’s hands will be better. The way to do that is lower taxes. Every 1% drop in the tax rate adds 3% to GDP. We have the highest corporate income tax in the world, and they are going higher under Obama. In addition, as George Stigler proved, regulations are artificial taxes on companies too. The US has ramped up regulation in recent years and expanded the role and scope of government every year since 2001.

We need a massive tax cut along with ending loopholes and subsidies. That fiscal action would shock our companies into action and you’d see a massive expansion.

Understand, the Congressional Budget Office and others score these things with the attitude of a Keynesian accountant. They don’t look at things through the eyes of a businessperson.

We spent billions trying it the Keynesian way. Why not try something different? What the hell are we afraid of? Failure? We have failed the last several years.

2012-09-06 06:18:37

Source: http://pointsandfigures.com/2012/09/06/the-ecb-solution/

Source: