| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

The Only 5 Stocks You Need to Retire

There are around 8,700 stocks listed in the U.S. — but what if I told you that you need only about five of them to build a lucrative retirement? It’s true.

For the past few weeks, I’ve been telling you about the power of a strategy known as “trend following.” It’s the same strategy used by high-end hedge funds to generate investment gains for millionaires and billionaires in any market — even this one.

So far, I’ve shown you what makes trend following a better way than buy and hold and an amazing profit chart of a simple trend system over the past two recessions and answered your questions about the strategy. Today, I want to show you how a trend following approach can let you stick with just five stocks to earn outsized profits with a fraction of the risk of buy and hold investing.

One of the most beautiful things about using a trend following strategy is that it’s hands off. Remember, the goal of this investment approach is simple: You want to identify big trends when they’re just getting started. So once you figure out what rules identify a trend (we’ve been sticking with simple moving averages so far), you can let the computer do the heavy lifting and tell you what to buy and sell.

But that doesn’t mean that you need to crunch those numbers for all 8,700 U.S.-listed stocks. Just a handful will do fine.

Why so few?

I realize that the idea of buying just a few names is probably foreign to most modern investors. After all, we’ve all had the word “diversification” crammed into our brain for the past few decades. But you can create a well-diversified portfolio with just five stocks — in fact, you can create a better diversified portfolio than most of your neighbors have with just those five names.

To answer why, we have to think about what you’re actually buying when you buy stocks. There’s a reason why people lump “stocks” into a big group — it’s because, for the most part, all stocks trade the same. We can measure that by figuring out the implied correlation of a group of stocks like the S&P 500 — right now, the implied correlation of everyone’s favorite index sits at 66.02. That means that around 66% of stock moves are happening together.

In other words 66% of the time that General Electric’s shares move, it’s not because the stock is announcing some important news or financial data. It’s merely because shares of Apple, Exxon and Citigroup are moving the same way.

That’s something that few retail investors realize…

Basically, when you buy a handful of stocks right now, around 66% of what you’re buying is going to move together no matter what. You’re buying a lot of the same thing. And buying a bunch of one thing isn’t diversification — in the real world, that’s precisely why almost all stocks fell like rocks in 2008 and why almost all stocks rallied hard in 2009.

To get real diversification, we need to focus on buying things that have very low correlation with one another. So that’s exactly what we’re doing for our trend following system.

How about the number of stocks we own? Even with low correlations, five seems like too few to protect us from getting hammered if one crashes. The truth is that owning five stocks has only around 6% more risk than owning 1,000 stocks does; ratchet your number of stocks to 10 and you’ve got only 3% more risk from being underdiversified. So you’re not exactly playing Russian roulette by owning just a handful of names.

As a trend following trader, though, you’re not trying to own a bunch of names to diversify your account — instead, you’re focusing only on trends, so you may only own one or two of them at any one time. Your stop losses provide the risk protection that diversification doesn’t…

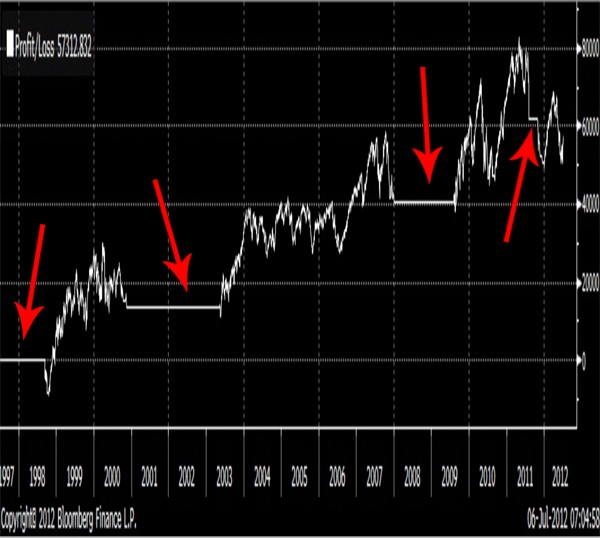

Here’s the trend following profit chart that I showed you before:

In the system that I used as an example, there was only one investment: the SPDR S&P 500 ETF (NYSEARCA:SPY). It’s a good proxy for “stocks” as a group. But look at the chart and you’ll notice something problematic about only using one stock for a trading system — there are a lot of times when the system says not to own that stock. I’ve drawn arrows at all of the places where you’re simply out of the market under that approach.

Adding other, low-correlated stocks to your radar (called your “investment universe” in pro parlance) means that you can increase your returns when the big indexes aren’t doing anything. One of the best ways to find low-correlation names is by turning to other asset classes.

Think about it: What if you’d owned gold during the first two flat spots and owned Treasuries during the last two? The system’s returns would have been much higher.

The best way to do that (particularly if you want the flexibility of stocks) is by using exchange-traded funds, or ETFs. ETFs are a way to get exposure to a whole asset class that’s as easy to buy or sell as any stock. While they do charge management fees (a percentage of your investment), those fees are lower than similar mutual funds typically are. They also have tax advantages.

What five ETFs might make up our investment universe? As a starting point, these five asset classes offer low correlations and an opportunity to “fill in the flat spots” in our trend following profit chart:

1) SPDR S&P 500 ETF (NYSEARCA:SPY) — I like SPY. It’s a good way to get exposure to stocks as a group, and it has clearly worked well under a trend following system in the past.

2) iShares Barclays 20+ Year Treasury Bond ETF (NYSEARCA:TLT) — Treasuries are a good way to get exposure to bonds’ movements and the income that they pay out. For a more refined system, a separate corporate bond ETF would be a good addition.

3) SPDR Dow Jones REIT ETF (NYSEARCA:RWR) — Real estate investment trusts, better known as REITs, have extremely low correlations with stocks and pay out significant dividend income for investors.

4) SPDR Gold Trust ETF (NYSEARCA:GLD) — Gold is an asset class unto itself. When times are volatile (such as now), the metal acts more like a currency than a traditional commodity. It’s a useful asset to have exposure to.

5) iShares S&P GSCI Commodity-Indexed ETF (NYSEARCA:GSG) — This ETF provides exposure to commodities as a group. Again, in a more refined system, I’d want to break this down further into individual commodity groups like energy, basic materials and agriculture.

This is a very simplified example of some ETFs that provide attractive exposure for a trend following strategy. In a real-world setting, there are some tweaks I’d recommend putting into place before using real money, but we’ll get into those later on…

For now, the important thing to remember is that the conventional wisdom about how many stocks you should own is bogus. Buying a bunch of stocks doesn’t give most investors the diversification that they think it does, and owning just a handful of names doesn’t ramp up risk as dramatically as so many folks think it does.

In fact, using just five investments in your portfolio can provide all the features you need to fund a lucrative retirement using a trend following strategy.

If you’ve been reading this column in Trend Playbook for a while now, I hope that you’re noting a pattern here: Each week, we’re adding another piece to the puzzle to turn a manageable and profitable trend following system into practice. Next Friday, I’ll show you another consideration to put this powerful strategy to work for you.

Until then, send any questions to [email protected]

Happy trading,

Jonas Elmerraji, CMT

Questions or comments? Drop us a line at [email protected]

The Only 5 Stocks You Need to Retire was originally featured in the Penny Sleuth.

This story was originally featured on Penny Sleuth.

2012-10-05 20:06:01

Source: http://pennysleuth.com/the-only-5-stocks-you-need-to-retire/

Source: