| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Close To The Panic Button

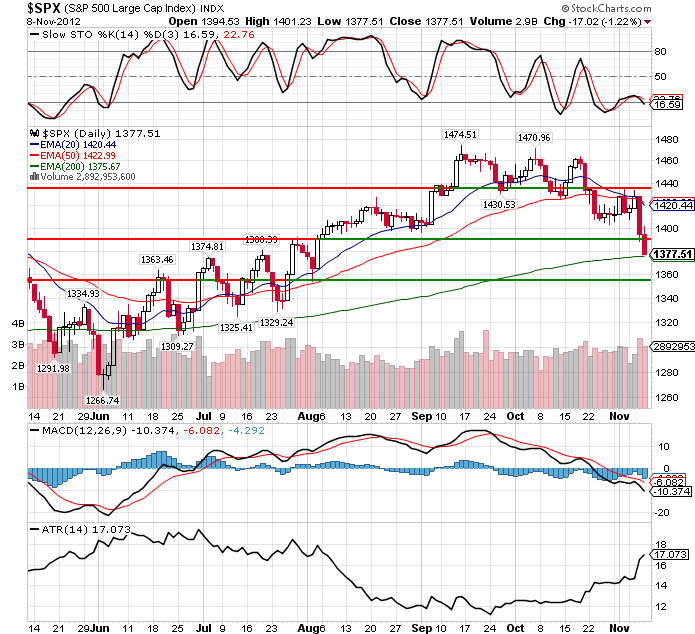

Normally a break of the 200dma would be the signal that we are either entering a bear market, or getting close to a reversal, Today we broke the simple 200dma, but the exponential average, just below it, is still holding. That could be a setup for a bear trap, but i would not bet on that. Volume has been high, and leverage has also been high (see the recent news story on Rochdale Securities), so we are likely seeing some margin calls coming in. That could lead to a situation where the smart money is waiting for the panic selling to begin, and start buying into the panic. We may not be there yet, but I think we are close.

There is no doubt about the Nasdaq 100, which is now well below either of the 200dma’s. AAPL may have been one of the most heavily leveraged stocks in the market, and it is taking a beating. How long this goes on depends on how much paing these hedge funds can take, and also on how leveraged they were. It may take quite a while for the dust to settle, and we could be quite a bit lower by the time it does.

The Russell 2000 has also lost the 200dma, and there isn’t much suppor below that. This looks like it is just beginning rather than ending.

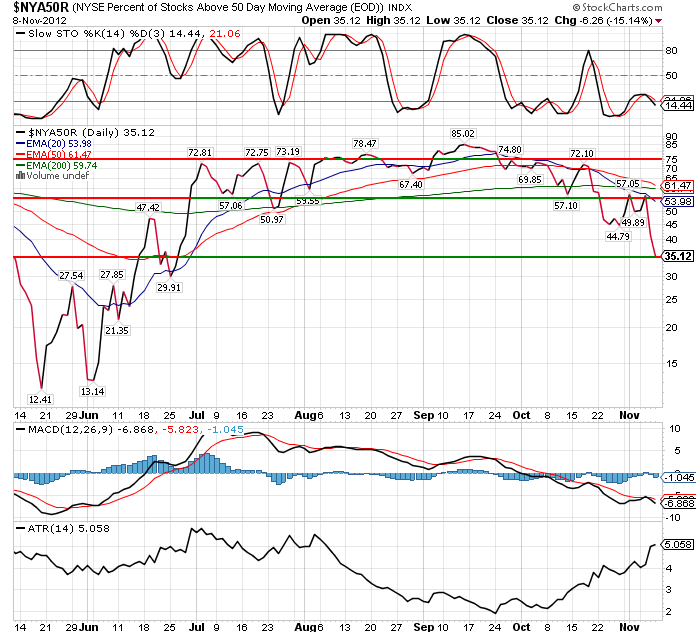

The percentage of stocks on the NYSE above the 50dma is also telling jus this might have longer to go. This is just now entering bear territory, and from a historical perspective, is likely to spend about a month (at least below that level. The good news is that if it drops quickly, it tends to reverse quickly as well. Worst case is a very slow blood letting which lasts weeks, or months.

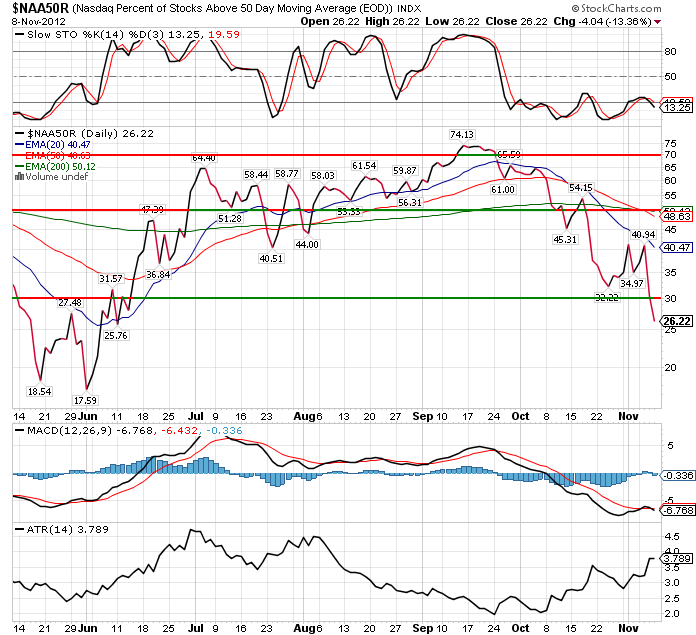

Judging by the Nasdaq, it looks like the “dropping quickly” scenario is most likely. This is well into bearish territory, and if it keeps dropping, will likely reverse within a week or so.

The market is in very high risk mode here. We have not really hit “oversold” yet, and panic is not very far away. When it gets there, look for anything and everything to get sold off as the highly leveraged high rollers start really getting creamed.

I will have the new highs update shortly.

2012-11-09 02:16:34

Source: http://samuraitrader.blogspot.com/2012/11/close-to-panic-button.html

Source: