| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Soybean futures setting up for a deeper move – be patient!

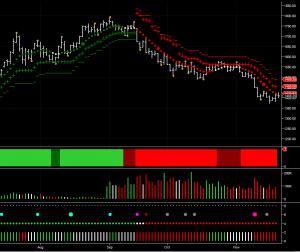

For traders in soft commodities, Soybean remains the stand out commodity for 2012, having delivered two outstanding trades since June. First a bullish trend run which saw the commodity touch the $1800 per bushel level, before reversing into an equally profitable trade, this time to the short side of the market, and which now looks set to extend further as we approach the year end.

The current bearish trend was first signaled in mid September with an aggressive volume entry ( the purple dot) subsequently confirmed with a conservative trend set up ( the red dot) three days later. Since then, the market has continued relentlessly lower, with only a minor pause in the $1500 to $1550 per bushel region, as buyers were tempted back into the market on the daily and three day charts. However, the key feature of this chart is the three day trend at the bottom, which has remained red throughout, confirming the longer term sentiment for the commodity. In the last few weeks we have seen a return of heavy selling pressure on both the daily and three day charts, and with the heatmap also now firmly bearish, we can expect to see soybean futures move lower once again.

However, before opening further short positions, a word of caution. In the last two weeks we have seen an isolated pivot low formed at $1391 per bushel, and a counterbalancing isolated pivot high at $1428 per bushel – a classic early warning of a market moving into a possible congestion phase at this level. The market attempted to break lower on Monday, but has since recovered to trade at $1408 per bushel at the time of writing.

So the watch word now is patience. The market is heavily bearish, and with little in the way of price support below, expect to see the market test the $1280 per bushel region in due, once we see a breach of the current area. The key level is $1372 per bushel, and a break below here will open the way to the next leg down.

All the above analysis has been done using Hawkeye software tools and indicators. If you would like to see Hawkeye in action, please just click the following link to join me in one of my Free live trading rooms - I look forward to seeing you there – Anna

By Anna Coulling

2012-11-23 21:58:17

Source: