| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Flatline Friday – Options Expiration Day Gives Drop a Pause

Wheeee – what a ride!

Wheeee – what a ride!

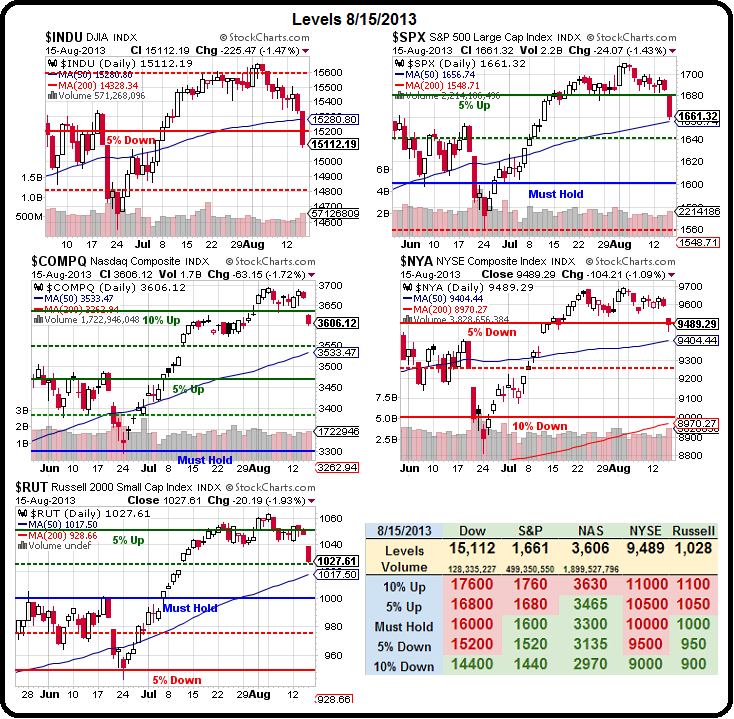

I love it when a plan comes together. After many, many false starts and even falser head-fakes, we finally got the dip we've been playing for. No big deal so far, just a bit below our 2.5% lines and we'll see if they can be taken back this morning at:

- Dow - 15,250

- S&P – 1,667

- Nasdaq – 3,607

- NYSE – 9,450

- Russell – 1,033

As I noted in Member Chat this morning, the NYSE is keeping us from getting much more bearsih as it finished 39 points (1.1%) over the line and it's right on our -5% support so we're keeping the faith that this is just a minor pullback and not the start of a major correction, though we won't know for sure until next week as today is options expiration day and you can't trust anything that happens today.

We've been having fun with our oil trades and, this morning, we're back at $107.50, which is our new favorite shorting line (was $106.50 but we backed off this week) and we had a detailed discussion about Futures Trading Strategies in our Member Chat this morning – very good reading, along with our usual news rundown and market overview. Thanks to some very cheap (and even negative) rolling costs this week, the NYMEX crooks have already shifted most of their FAKE September orders to FAKE October orders:

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | |||||||||

Source: http://www.philstockworld.com/2013/08/16/flatline-friday-options-expiration-day-gives-drop-a-pause/