| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Fed Speak Week – 11 Fed Speakers Aim to Steer the Markets

Let the manipulation begin!

Let the manipulation begin!

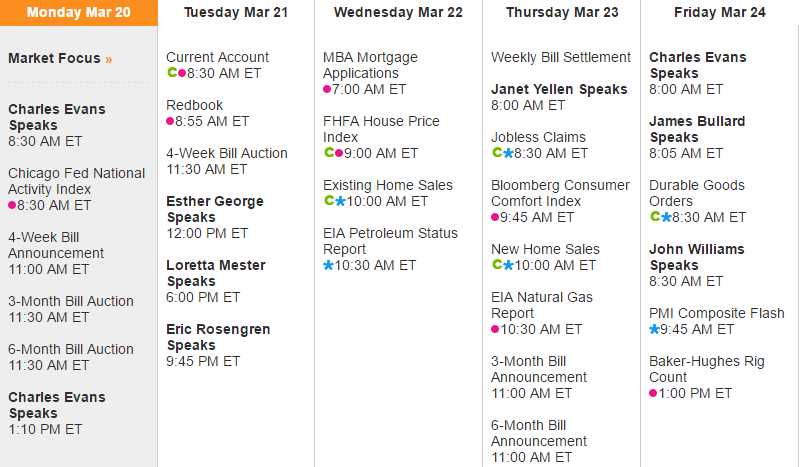

After a 0.25% rate hike did nothing to deflate the market bubble, the Fed will take another swing at things this week by speaking to us 11 times and it will be Evans (Dove), Evans (Dove), George (Hawk), Mester (Hawk) and Rosengren (Dove) on Monday and Tuesday followed by Yellen (Dove), Kashkari (DOVE), Kaplan (Neutral) , Evans (Dove), Bullard (Hawk) and Williams (Neutral) on Thursday and Friday. So an edge to the doves but the doves had a 3:1 edge last year, so it's a change in tone towards hawkish for sure. Kashkari was the dissenting voter who did not wish to raise rates at last week's meeting – he speaks Thursday at noon.

In their recent statement, the Fed says “The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal.” The word symmetric was added since January and indicates the Fed is warning that they do not intend to let inflation move over 2% for any period – that should be clarified a bit this week and it's a key indicator that the free money party is really winding down.

As we noted in our Friday Morning Report, the recent Fed action has driven the Dollar to the bottom end of its range, back to where we bottomed out at the Feb 1st meeting, after which we climbed back 2.5% over the next month and, unless the Fed speakers come off surprisingly doveish this week, we can expect the Dollar to rapidly move back to its mid-range at 101.50 and that will put pressure on commodities as well as the indexes.

Oil (USO) is already under rollover pressure with 3 days to trade April contracts (/CLJ7) and already we're down to $48.50 ($47.90 on April) and we hit our $49.50 shorting goal on the May contracts (/CLK7 – also from Friday's report) so you are welcome for that $1,000 per contract winner to start your week off with a smile. Our index shorts (same post) have had minor pay-offs so far but, as noted in the Report, we're confident enough in our index shorts at this point that we're beginning to short specific stocks ahead of a broad-market “adjustment.”

Provided courtesy of Phil’s Stock World.

To read the rest of this article now, along with Phil’s live intra-day comments, live trading ideas, Phil’s market calls, additional member comments, and other members-only features – Come to the winning side at Phil’s Stock World by clicking here.

To sign-up for a free trial membership, click here.

Source: http://www.philstockworld.com/2017/03/20/fed-speak-week-11-fed-speakers-aim-to-steer-the-markets/?utm_source=beforeitsnews&utm_medium=feed&utm_campaign=psw-feeds&utm_content=article-link