| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Interest Rates Rise – Impact on US Stock Indices?

BarroMetrics Views: Interest Rates Rise – Impact on US Stock Indices?

Non-Farm today and I am expecting a figure that is is at least on the better side of consensus (Consensus range: 162K to 240K, Consensus: 200K).

If I prove correct, that will clear the path for the FED to raise rates. That it would, provided the job figure produced no surprises, was made clear by Kaplan and Fisher. It was also confirmed by Yellen.

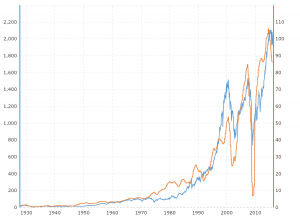

Let’s assume rates do rise. What effect will that have on the S&P?

I suggest very little in the way of a bearish reaction.

I see this current move as being the last leg of the 13-w bull market that started in 2008. It’s what I call an R2 move (parabolic rise) that is driven by sentiment. My sentiment tools rate the current move to be on par with the 1987 top. Gann Global has a possible date for the top in the time zone, March 17 to April 10.

However, I do think we’ll see a bullish reaction, given that the S&P is in a parabolic move up. Gann Global has a possible date for the top in the time zone, March 17 to April 10. I’d like to see the S&P put on another 10% before I become overly bearish. In the meantime, I am keeping an eye on the corrections: a 3% drop will signal a top is in place.

The post Interest Rates Rise – Impact on US Stock Indices? appeared first on Ray Barros' Blog for Trading Success.

Source: http://www.tradingsuccess.com/blog/interest-rates-rise-impact-us-stock-indices-4702.html