| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Small Cap Value Report (Thu 23 Mar 2017) – NXT, RBG, SPE

Good morning!

I did another big session of writing last night. So yesterday’s report was greatly expanded, and now covers results/TUs from: Xaar, James Cropper, Eckoh, SoftCat, Quixant, Cello, CloudBuy, and Van Elle. Please click here to see the full report.

Today I intend reporting on the following results amp; trading updates:

Sopheon, Tracsis, Science In Sport, Safestyle, The Mission Marketing.

Firstly though, a quick mention of results out from Next (LON:NXT) . As retailing is my sector specialism, I always read Next’s figures with great interest, as there’s so much information that has wider significance. A couple of things struck me.

As always, its results just reinforced what a fantastic business Next really is. It generates such a high operating profit margin, that most retailers can only dream of. Also, even in a bad year, it throws off huge amounts of cashflow.

Most retailers have a tail of loss-making shops. Next doesn’t. 97% of its store turnover is generating at least a 10% profit margin! 74% of its store turnover is generating over 20% profit margin. Truly remarkable figures, this is such a great business.

Selling price inflation – seems to be around 4-5%, driven mainly by the depreciation of sterling. That doesn’t seem too bad to me.

Living wage amp; other cost pressures – look like they’re going to be largely absorbed through efficiency amp; cost-cutting elsewhere. That includes reducing staff incentives – so clawing back by reducing bonuses, etc, presumably.

Guidance on EPS – quite a wide range. The low end is -12.4% drop in EPS this year versus last year. The upper end is a rise of 0.5%. So a fairly gloomy outlook, although isn’t it always with Next? They seem to like starting the year with depressing guidance, then usually perform better.

Rents – this is the most interesting bit, a section called “retail space expansion”. Next is still opening new stores, and crucially is now being offered excellent deals by landlords. A table is provided showing that rent/sales in existing stores is 6.6% (that is extremely low!). However, on new sites opening in 2017/18, rent/sales drops to only 5%.

The broader point is that any retailers or leisure operators that are currently expanding, are obtaining superb deals for new sites. This counteracts other problems, such as living wage, apprenticeship levy, business rates rises, etc.

The same factor is happening with Revolution Bars (LON:RBG) (in which I hold a long position). When I recently met management, they outlined the amazing deals that are being secured on new sites, e.g. a 6,000 sq.ft. site in central Reading, obtained at a rent of only £90k p.a.! That’s a fraction of what I would have expected.

Therefore, any retailer or leisure operator that is expanding at the moment, should be getting fabulous returns on their investment. Next mentions a 2-year payback on its new sites, which is just ridiculously good. RBG obtains an ROI on new sites of 38%, so that’s a payback of under 3 years, which is very good indeed.

So I feel that High Street retail/leisure is far from dead. Rents are beginning to adjust downwards. That should, over the long term, improve competitiveness amp; profitability for those that survive, and especially those that are currently expanding amp; taking advantage of some terrific deals from landlords desperate to re-let empty shops.

The problem for existing retailers, is that the upward-only rent review system means that they’re stuck in expensive shops until the lease expires (usually 15 years at the start). Then when the lease expires, they can either vacate, or renegotiate a much lower rent.

I definitely would not want to invest in any property companies that own retail space, as they’re looking at a future filled with pain.

As for Next, I think it looks very interesting at the current level, so am going to buy some now. Pity I wasn’t quicker on the uptake this morning, as it’s already up about 7% today.

Sopheon (LON:SPE)

Share price: 495p (up 4.2% today)

No. shares: 7.4m (NB. plus 2.614m dilution from convertible loans) = 10.0m

Market cap: £36.6m (increases to £49.5m once loans converted)

Audited results – for the year ended 31 Dec 2016.

This software company is certainly on a roll. It put out a very positive trading update in Jan 2017, indicating that 2016 figures would be significantly ahead of market expectations at the time. This was driven by ;

- large number of licence orders in Q4

- cost efficiencies

- forex gains from the fall in sterling

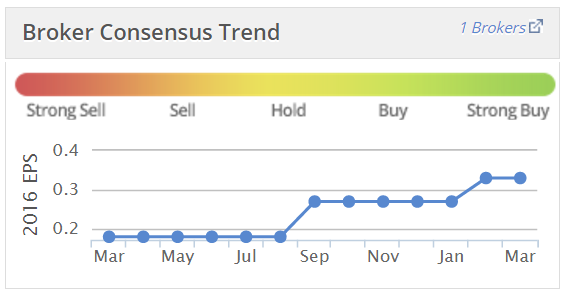

As a result, broker forecasts look to have been raised in Jan 2017 from 27 cents, to 33 cents EPS. You can see from the Stockopedia graphic below that forecast EPS almost doubled over the last 12 months;

Results today are skewed by a $1,275k income tax credit (starting to recognise a deferred tax asset), so the reported basic EPS of 59.05 US cents won’t be comparable to the broker forecast, which would have used a normalised tax charge.

Doing some quick sums, if I change the tax credit to a 15% charge, then EPS drops out at 34.8 cents. On a 20% tax charge, EPS is 32.8 cents. So it looks as if today’s results are in line with the 33 cents latest broker consensus. An analyst email I got earlier this morning also confirmed that is his view too.

Here are a few numbers;

Revenue up 11% to $23.2m

Profit before tax up 125% to $2.7m

EBITDA figures for software companies are meaningless, since that number ignores both development spending and amortisation, which is clearly nonsense.

Outlook comments are rather scattered, throughout the narrative in today’s announcement. The order book is up nearly 21%;

Full year 2017 revenue visibility of $14.5m, compared to $12m the previous year.

Directorspeak – the Chairman sounds upbeat;

“I am delighted to report a truly excellent set of results; the board looks forward to building on these results to deliver continued positive development in the strategic and financial performance of our company in 2017 and beyond… Additional investments in new members of our team are another key piece of our strategy to move our business forward and capture the opportunity that we have long believed was coming.

Sopheon has a market-leading solution, global reach, solid financials, a clear corporate structure, an accelerating market, and most importantly great people – a real platform for growth.”

Convertible loans – it looks as if the company was financially distressed in the past, and convertible loans of £2m were issued (funded by the Directors, and an investor called Rivomore).

The trouble is that the conversion price of these loans is 76.5p. That was probably perfectly reasonable at the time, but now the share price has soared to 495p, clearly these are now very lucrative instruments for the holders.

So if £2m of loans are converted into equity (which they certainly will be) at 76.5p, then that means the issue of 2.614m new shares. That would increase the share count from 7.4m at the moment, to just over 10m, which represents very heavy dilution for existing holders – it’s an increase in the share count of 35.3%.

So the current market cap is not really £36.6m, it’s £49.5m.

Therefore it’s vital people are aware of this issue, in order to correctly value the shares.

There’s also further dilution from about 300k in the money share options too.

My opinion – one of the reasons I rarely invest in software companies these days, is because licence revenues are such high margin (almost entirely profit), that they can lead to extremely volatile profits. It’s fine in the good years, but if licence revenues go into reverse, then it can cause a dramatic, geared hit to profits.

For this reason, you have to be extremely certain that a software company is indeed on a roll, and will be growing its licence revenues. Otherwise, trouble could strike very easily, if a shortfall emerges. Think Brady, or Tribal Group, for examples of this happening in recent years.

Sopheon does have some recurring revenue too. The ratio of revenues has been almost static throughout 2016 amp; 2015, at 29:37:34 ratio of licences:maintenance:services. However, it’s the licences which moves the profit dial the most, as they’re pure profit.

So shares like this are not without risk. However, at the moment it does look as if Sopheon is really going places, and let’s hope it continues. To what extent is the good news already in the price? The share has gone up from c.87p to 495p in the last year, so the market has already recognised a big improvement in profitability.

Source: http://www.stockopedia.com/content/small-cap-value-report-thu-23-mar-2017-nxt-rbg-spe-177264/