| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

This New Trade is Just Beginning to Heat Up…

This post This New Trade is Just Beginning to Heat Up… appeared first on Daily Reckoning.

The tech sector has done most of the heavy lifting for the stock market so far this year.

As a group, technology stocks are up 11% year-to-date. Household names like Apple, Cisco, and Facebook are dominating the major averages. If you’re looking for strong stocks, you might think there’s nowhere else to turn.

You’re wrong.

Despite what you’ve read in your daily finance tabloid, there’s a hot new trade quietly thrashing Wall Street’s tech darlings. These stocks are up a collective 17% since the calendar flipped to 2017. That performance easily tops tech and the other eight major market sectors.

It gets better. Not only did this group of stocks endure not one but two major drawdowns in 2016, it also tanked to new 52-week lows exactly one year ago during the winter correction. Unlike the market’s high profile tech stars, owning these stocks was dead money walking just a few months ago.

Get ready – the homebuilder comeback is upon us.

Yes, it’s the homebuilder stocks that have gone from zero to hero in 2017. The whipsaw moves that frustrated investors over the past 12 months have subsided. As the post-election rally matures, homebuilders have quietly become some of the strongest stocks on the market.

If you jump onboard now, the market’s giving you a strong chance at owning one of the best performers of 2017.

This homebuilder rally is no dead cat bounce. We’re seeing several positive catalysts beginning to converge that will help power these stocks higher in the weeks and months ahead.

The first is sentiment.

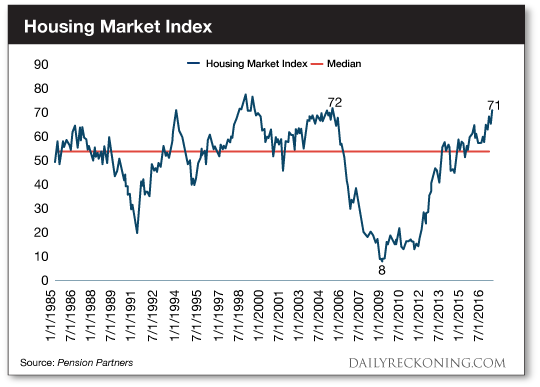

The National Association of Homebuilders confidence index just jumped to 71. That’s the indicator’s highest reading since June 2005 – the height of the real estate bubble.

Does this mean we’re headed for another financial crisis fronted by a housing bust? Probably not. After all, it’s taken more than a decade to crawl out of the rubble left by the housing bubble. Even with rising rates and robust confidence, an outright crash isn’t showing up in the tealeaves.

In fact, rising rates are beginning to push potential buyers off the sidelines in many markets. With the specter of a larger monthly payment looming, buyers are motivated to get off the couch and lock in their rate.

The NAHB is also giddy over a Trump executive order. The organization says confidence is up because Trump squashed a “burdensome” clean water rule.

Yep, you guessed it: Less red tape makes builders happy…

“In past cycles, stronger builder sentiment has signaled a stronger pace of construction, but builder activity has been tepid in the years since the housing crisis and recession,” MarketWatch reports. “In recent months, housing starts have been less than two-thirds of their average over the past 50 years.”

The effects of the housing crisis didn’t go away overnight. While the Fed gave the stock market the fuel it needed to sprint off its 2009 lows, homebuilders were left to deal with the fallout from depressed real estate prices. That resulted in new home construction grinding to a halt in most parts of the country.

But that’s quickly changing. We’re now a full decade removed from the housing bubble. Inventories are tight. Buyers are lined up and ready. It’s time for a monster rally after ten years of little to no substantial gains from the homebuilder stocks.

We’re already seeing signs that the new homebuilder rally is ready to extend higher. Look no further than the big box home improvement stores.

Home Depot (NYSE:HD) is a great barometer for the health of the housing market. Last year, the stock didn’t impress investors. In fact, it came close to a complete breakdown just before the election. But in late February, we noted that there was at play than a rising tide. Home Depot crushed earnings. Rival Lowes Companies (NYSE:LOW) followed Home Depot’s performance by posting its own new all-time highs late last week.

I don’t have to tell you that Home Depot and Lowes hitting their stride is a bullish signal for the housing sector.

Right now, it’s clear that there’s a major breakout is taking place for the once-underperforming homebuilders. Grab shares today and you have a good shot at profiting from one of the strongest trends of 2017 from the very beginning of the move…

Sincerely,

Greg Guenthner

for The Daily Reckoning

The post This New Trade is Just Beginning to Heat Up… appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/new-trade-just-beginning-heat/