| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

You Cannot Chase A Trade

One of the things common in trading and investing in companies is emotion. There is the thrill of the chase. It can consume you. Sometimes, you get so involved, you ignore common sense and toss it to the wind. Discipline is a skill that great investors learn. Often it’s learned the hard way.

When you invest in companies, you do get consumed. Great investors will tell you they “fall in love” with a company. No matter how much data you look at, if they don’t feel that emotional pull to a company they won’t invest. Want to see how strong that emotion is? Get a startup investor to talk about a failure and get them to talk about how they felt about the company before they invested. That’s why startup investing can be so painful. You not only lose money, but something you fell in love with dies. By the way, traders fall in love with trades too.

It’s also why the team is so important. Good investors build a relationship with the management team. That also brings emotion into the deal. No matter what the math is, if the team can’t execute then the startup is going to fail. Team is the deciding factor. But, valuation and check size matter. Investors are in the game to make money, not just invest in good people and go for a ride.

There are a lot of good common sense reasons not to invest in a startup. That’s because when you apply common sense, you look at the world as it is today not as it could be. Hence, if you look at any recent vintage venture capital portfolio through the lens of today, it’s easy to think the investments are all nuts.

If you ask a VC about their investments, they should be able to at least answer all your real world objections about the company. By the way, never tell a VC that “their dog can’t hunt”. At the same time, there is a point where the real world collides with the fantasy world. It’s in valuation and exit value of the company.

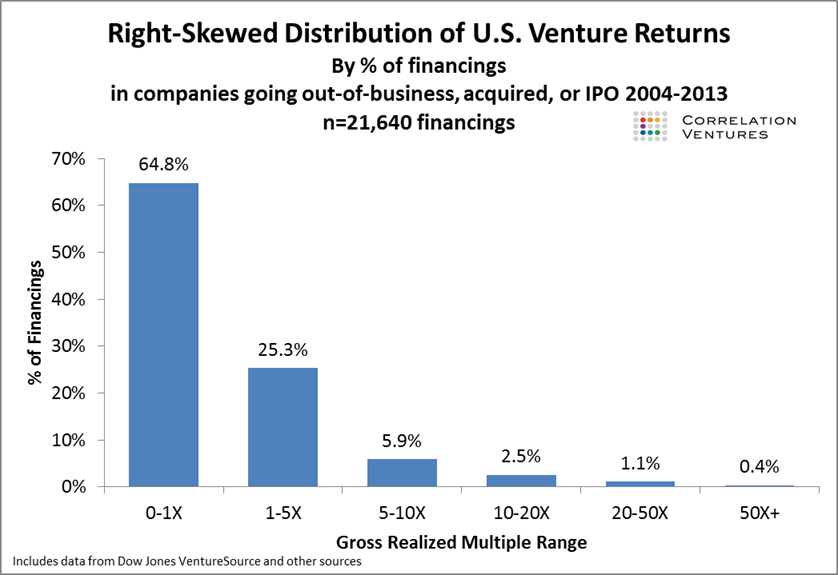

I was reading this blog post and those thoughts occurred to me. Venture returns have a positive skew.

If you are at all familiar with trading options, you are familiar with skew. As markets move, the skew of the options move based on market sentiment and intrinsic volatility. Puts get more expensive in down moves or as sentiment gets bearish. If you plot them you can see how they graph. You will hear options traders say, “We can’t do that trade, it’s too expensive.” That has to do with the risk/reward preferences of the trader and how they plot the skew versus what the markets actual skew is.

Here is what the actual distribution of returns looked like from 2004-2013 thanks to Correlation Ventures and Foundry Group’s Seth Levine for posting it. A top-tier venture fund will return 3X or better.

Quoting from the linked blog post, here is quick and dirty math to see if you should make an investment in a startup or not.

Fund Size / % owned at exit = Minimum Viable Exit

If you are an angel investor, fund size equals how much you will commit in total to angel investing.

Because of the variables, different funds can do different deals. What looks like a good deal to a $50M fund doesn’t look like a good deal to a $250M fund or $1B fund. It also changes the way different investors interact with the company at different stages. If a $50M fund is sitting at the table with a $1B fund and a potential exit is on the table, they are liable to get into a pretty heated argument.

Data consistently shows that smaller funds do better than larger funds. This is replicated over and over again. The sweet spot for fund size is somewhere between $100M-$250M. It would be interesting to see a study on partners/fund size and compare returns. My gut says $20M-$25M per partner is a good metric but it’s just gut.

When you layer on valuation, the venture game takes on a new complexity based on probability. As seed fund manager Charlie O’ Donnell writes, “If prices are 2x higher, then we’re looking at high teens returns for just the seed round’s returns, and mid for the whole ball of wax if you follow on. Seed round returns are particularly sensitive to exit valuation–because what might seem like a million bucks here and there is actually a lot on a percentage basis.”

Going back to the quick and dirty equation, one of the most important things smaller funds can do is own a larger chunk of the firms it invests in. Most people think that investing in a lot of firms will lead you to have a better probability of success. Spread out the risk. Makes sense right? This is similar to the marketing plan of throwing a bunch of stuff to the wall and seeing what sticks.

But, the actuality is it all depends on initial check size and percent ownership at exit. This is why seed valuation is so critical. It’s also why it is very tough to be a generalist, and be a smaller fund (sub $100M). If you are going to write a big check and own a large chunk of the startup at an early stage, it really helps to know the ins and outs of the industry you are investing in.

This brings me back to the title. If valuations go up, should you chase deals? That all depends on how big of a check you can write, and what you think the exit value of the company will be. Because it’s almost certain that the top-line revenue of the company doesn’t come close to supporting the valuation. Of course, it really comes down to the team. Do you think you can work with them and can they get the company to the promised land? Sometimes walking away from a deal is the right thing to do.

Source: http://pointsandfigures.com/2017/03/28/you-cannot-chase-a-trade/