| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

There’s An Exception to Every Rule – Here’s One

“Shale production is uneconomic and I will claim that to my dying day”

Those are the words of Jim Chanos who runs the most successful short-selling hedge fund in the history of the business. Now Jim, really–tell us what you really think. In early January I wrote a story on how Chanos was shorting Royal Dutch Shell. Now he’s spreading his talk to include the shale producers.

I focus all my attention on energy—and I think he’s right. Shale production is mostly uneconomic, though I think A Big Reason for that is the industry’s determination to grow faster than it should.

But the industry sets itself up for a smart short player every cycle. Big Profits is just about timing your shorts, just like timing your longs. 99% of all shale oil & gas stocks are to be traded, not held long term.

An Open Mind Is A Valuable Tool For An Investor

Once I buy a stock, I am always looking for contrarian opinions on it. They are valuable; and keep me honest.

Strong investors constantly look for opposing views. It forces us to critically analyze our own line of thinking. It forces intellectual honesty, and helps avoid expensive mistakes.

So when that contrary opinion comes from someone with the track record of Jim Chanos—I listen close.

Source: Yale Alumni Magazine

Chanos is the founder and managing partner of the hedge fund Kynikos Associates. It is the largest short focused investment firm in the world.

To be clear, what Chanos does as a short-seller is make bets against specific stocks or groups of stocks. If the share prices of those companies go down he and his investors make money. If share prices go up they lose money.

As a short-seller the deck is stacked against you. Over time most stocks go up simply because companies retain earnings which increases their value. Just the influence of inflation alone pushes stock prices higher over time.

Shorting is a very difficult business. Very few people actually make a living at it.

Chanos has lasted more than 30 years. That gives his opinion credibility.

On his list of successes includes betting against the demise of companies like Baldwin-United, Commodore International, Coleco, Integrated Resources, Boston Chicken, Sunbeam, Conseco and Tyco International.

His biggest and most famous investment success involved be front and center in outing the giant fraud that was Enron.

Like all of us, Chanos isn’t correct every time. But he is correct a lot more often than he is wrong.

More importantly, the thesis behind his short bets are always well thought out and worth considering.

The Problem Chanos Has With Shale – No Free Cash Flow….. Ever

Chanos is bearish on North American E&P companies, specifically shale producers. And he indicated that his firm has recently been getting more aggressive in betting against companies in the sector.

As a short-seller who has lasted three decades you can bet that Chanos isn’t basing this opinion on a “gut-feel” or a Wall Street rumor. He is basing this opinion on the number crunching that he and his firm have done.

Chanos has gone through financial data of shale producers looking at cash flows, returns on capital and well cost depreciation. His analysis tells him that this is a business that earns very, very poor or negative returns on capital invested.

Here are his exact words:

“Basically, the frackers had no free cash flow when oil was $100 and gas was $4. They had no free cash flow when oil was at $30 and gas was $2 and they have no free cash flow now with oil at $50 and gas at $3. So, you tell me when they’re going to ever throw off free cash flow?

“And yet the capital markets have now reopened to these companies and they’re going to gear up production again. So, we think this is a very scary area and we think investors should be cautious.”

Now, we don’t get to know which specific companies Chanos is betting against—unless he specifically tells us. The SEC only requires that hedge funds disclose their long positions—so we can’t actually see what they have shorted.

Investors should note that he isn’t the only successful big-name hedge fund manager singing this tune.

Greenlight Capital’s David Einhorn (another investor with an enviable record) had the following to say in his year end 2016 investor letter:

Short oil frackers - Despite repeated claims in their slick presentations, the economics still don’t work when all investment and corporate costs are taken into account. We thought the well of investors willing to sink cash into money-losing holes would begin to run dry, but the “drill-baby-drill” attitude of a TP (Trump Presidency) is likely to lead to additional mal-investment.

This will lead to lower commodity prices and still deeper losses. Further, due to various existing subsidies, oil frackers are generally not cash tax payers. The proposed corporate tax cuts don’t help much when you don’t pay taxes in the first place.

Einhorn is known to be short Permian producer Pioneer Resources (NYSE: PXD). Based on his 2016 year-end letter it sounds like he is short multiple North American shale oil producers in addition to Pioneer.

Shale Production Has Its Exceptions

I agree with much of what Chanos and Einhorn have to say about shale oil producers. The lack of sufficient returns on capital spent is a huge problem for the industry.

For most companies—but not all.

Interestingly the same things that Chanos and Einhorn have to say about shale oil producers–is true for their own hedge fund industry.

The vast majority of actively managed hedge funds do not beat the much less expensive S&P 500 index funds that investors could opt for.

Most hedge funds aren’t worth their expensive fees. But some are.

And there are shale oil producers worth investing in. The key is being extremely selective and finding the right ones. It’s also very important to remember that the Market isn’t just about fundamentals. Market psychology is important short to medium term. (If I had to give all my money to a psychologist or an economist, I’ll choose the psychologist.)

Fundamentally though, investors want to have some exposure to the companies that have locked down the best land positions in the best shale oil play. Land positions that do allow for economic development at current commodity prices.

Let me give you an example.

In July of 2016 I added Resolute Energy (NYSE: REN) to the OGIB portfolio. In Resolute and its Delaware Basin acreage I saw the very best of what the shale business can offer.

The key for me (what differentiated Resolute) was being able to see it with my very own eyes. Or more accurately compute it with my very own spreadsheet.

Unlike most shale producers Resolute provided investors with very clear data on all of its well results.

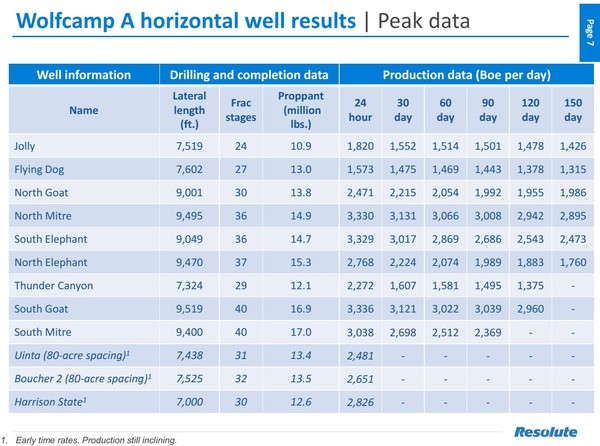

Source: Resolute Energy Corporate Presentation

With the data provided I was able to determine for myself the kinds of returns and payout periods these wells offered on the cost required to drill and frack them.

Needless to say I liked what my spreadsheet told me.

The market figured it out pretty quickly too taking Resolute’s share price from $3 to $40 in a pretty short period of time.

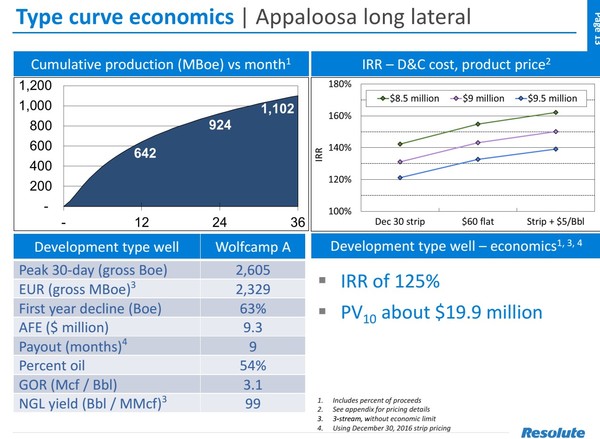

Source: Resolute Energy Corporate Presentation

Obviously, when Resolute has such a great property it is also willing to disclose a lot of data—and often—on its well results.

Much of the rest of the industry is much less transparent because they do suffer from the poor returns on investment that Chanos and Einhorn refer to. Einhorn actually refers to the idea that most shale producers cover up the true economics of their operations with “slick presentations”.

Again, I agree……..but there are exceptions like Resolute.

That is why as investors we must be very selective in choosing which shale oil producers to own, just as we should be selective in choosing which fund managers to trust with our money.

EDITORS NOTE: A recent M&A transaction in the US oilpatch says one of my largest positions could be worth more than 3x its current trading price–even if oil and gas prices stay right here. Big upside, little downside. You can have a risk-free look at my full report on this fast growing company–Click HERE.

Copyright © 2011

This feed is for personal, non-commercial use only.

The use of this feed on other websites breaches copyright unless you have written permission from Keith Schaefer of Oil and Gas bulletin to republish. If this content is not in your news reader, it makes the page you are viewing an infringement of the copyright. (Digital Fingerprint:

3r5723475234957asdgvaisduthadsfg)

Source: https://oilandgas-investments.com/2017/oil-stocks/theres-an-exception-to-every-rule-heres-one/