| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Saddle up for bubble phase in Gold & Silver

Where Are We Now

The environment is one

that Gold should be thriving in with negative real rates, western banks

are ready to intervene again (IMO we will see QE3 within the next couple

of months which might drive the start of the new trend in Gold),

non-western banks are buying Gold, the geopolitical situation is still

shaky and there is risk the Iran situation pushes Oil and Gold higher…

nothings changed, so stop rocking back and forth and shaking in the

corner because the value of your Gold has dropped. Get back on the

horse.

|

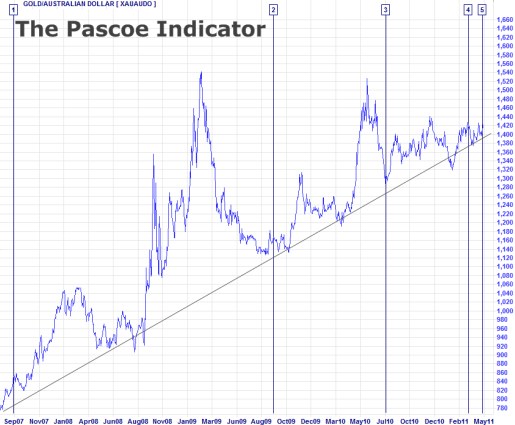

| Gold fell below trend in last major correction also |

I also pointed out several other indicators (sentiment, volume suggesting capitulation) were suggesting a bottom was in or very close.

First I would like to

clarify what I meant by a “bottom” in Gold and Silver. There is of

course the potential for Gold and Silver to trade lower than the recent

lows at $1526/$27, however I think there is a good chance that these

prices formed a low point which won’t be breached again before the end

of the bull market (if ever).Big call I know. One

which may prove to be wrong, but the only scenario I see the metals

going a lot lower than these price points is in a credit crunch similar

to that seen in 2008 and I think that there is enough gunpowder left in

the barrels of the Fed, ECB and other intervening central banks to push

risk of such a crisis down the road.

Miss out on this buying opportunity at your own risk. Current prices are a gift.

I was a heavier buyer of

physical Silver at the lows seen in late 2008. I am a buyer at current

levels and I think $26-28 Silver will be seen as a catch when the price

is much higher in the months and years ahead.Those who bought Silver

in late 2008 at US$11 instead of catching the exact bottom at US$9 are

probably not all that concerned that they didn’t catch the exact bottom,

they are happy they got in before the price multiplied over the years

following.Within 4 months of the $9

low in October 2008, the price of Silver had rallied over 60% to almost

$15. A price move like that today would take us back into the $40s and I

wouldn’t be surprised to see such a move over the coming months if the

European situation has been stabilised.

|

| Gold breaks out and finds support at 200DMA |

|

| Silver breaks out and finds support at 200DMA |

Central Banks have announced “unlimited” quantitative easing measures, the first announcement just over a week ago from the ECB:

Overnight Mario Draghi announced the new emergency program designed to support the ailing Eurozone. Most of the package was leaked out prior to the meeting so it wasn’t too much of a surprise when it was announced. The “unlimited” scale was, however, certainly an upside surprise. Macro Business

From FOMC Statement: To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. Macro Busines

Deflation, contraction and debt cancellation could come about as opposed

to the hyper-inflationary, end of all fiat currencies destruction that

some predict. Although I don’t think Bernanke & The Fed are going to

go down this path (deflationary) without a fight. They have continued

to highlight that they are “prepared to use their tools to promote a

stronger economic recovery in a context of price stability”. I think

2012 is likely to bring in the use of increased stimulatory measures by

the Fed, most likely to be publicly titled as QE3 (4/5/6?).It is my opinion that these last ditch efforts by the Fed to avoid

deflation will send the USD tumbling and Gold soaring as it launches

into the final bubble phase of this bull market. The deflationary bust

that briefly predicts could come about after this in a couple of years

and be the driver of Gold’s bear market following the bubble.

The next major potential shock to metals prices is if South African

mines go “offline.” South Africa is responsible for the production of 80% of the world’s platinum and is also the world’s third largest gold producer. South African miners went on strike on August 10th at a mine owned by Lonmin Plc, a British platinum producer and the third largest in the world. The situation drastically escalated on August 16th when the police lost control of the situation and fired live ammunition at the strikers, killing 34 of them and injuring 78.

There are now calls by some South African politicians and political organizers for a general strike

among all South Africa miners. The reason gold owners need to watch

this situation is because of the effect the strikes are having on

platinum prices. The disruptions right now are relatively minimal, but

it has already caused platinum to rise almost 20% as of Wednesday, and the linked article was written before

QE3 was launched today. If the strikes spread and South Africa stops

exporting precious metals for a significant period of time, there are

going to major supply disruptions. Platinum will be affected the worst

by far, but gold supplies will also be squeezed. This is on top of what

is already going on with QE3. Doomberg

The Doomberg blog post also refers to tensions between Israel and Iran having the potential to drive an oil price shock (although the official Israel stance is that no war is imminent).

In my opinion the situation in Iran is a powder keg ready to blow. High levels of inflation are driving a very unstable currency situation:

Iran’s inflation rate rose to 23.5 percent in the month that ended on Aug. 20 from 22.9 percent the previous month, the central bank said today on its website.

While the central bank said in its report that inflation will continue to increase, President Mahmoud Ahmadinejad said in a televised interview late yesterday that “the inflation growth rate has declined this year. The inflation rate will decrease in the second half of this year.” Bloomberg

- Price action is mimicking a bubble chart- Similar length of time to 1970s bull market- Mainstream media coverage increasing- Record mint production of retail products- Shortages of retail sized products- Premiums where retail public is buying

It’s

been my opinion for a few months now that we are entering the 3rd phase

of the precious metals bull market. I believe that there is not much

time left in this bull market and that we will have seen the peak within

2-3 years (max), quite possibly much sooner.

That does not mean I’m about to close my positions at today’s prices.

It does not mean I think the metals are close to a “price” peak.

All

it means is that I think the bull market will soon come to an end

(likely in a parabolic blow off) and there have been several indicators

that are leading me to this opinion.

That was all in this post: Gold/Silver entering the 3rd phase of the bullmarket?

Gold continues to have increased coverage in mainstream media. Where a few years ago Gold/Silver commentators were rarely seen on CNBC and other news programs, we now see them regularly and even the hosts themselves have mentioned high price targets and manipulation without laughing in the same sentence.

Not only is Gold now enjoying a strong presence in mainstream media, but suggestions of return to a Gold standard have moved from fringe political candidates to that of the Republican party:

The gold standard has returned to mainstream U.S. politics for the first time in 30 years, with a “gold commission” set to become part of official Republican party policy.

Drafts of the party platform, which it will adopt at a convention in Tampa Bay, Florida, next week, call for an audit of Federal Reserve monetary policy and a commission to look at restoring the link between the dollar and gold.

The move shows how five years of easy monetary policy — and the efforts of congressman Ron Paul — have made the once-fringe idea of returning to gold-as-money a legitimate part of Republican debate. CNBC

I think return to a Gold standard is extremely unlikely in the near term, but the very fact that it’s being discussed rationally by a regular political party is very interesting and a sign that Gold as a monetary unit is not so extreme an idea anymore.

Price Targets

|

| GSR Currently 51, expecting a fall back to 20 or lower as in 1980 |

Another easy way to demonstrate that gold is not in a bubble is to look at the inflation-adjusted highs. The nominal highs for gold and silver occurred during January of 1980, when gold topped out at $850 and silver at $49.45. Official government inflation statistics tell us that in today’s dollar terms, gold would need to reach $2,500 and silver $150 before matching their true 1980 highs. But it is well known that the government significantly understates the inflation rate in order to mask the impact of their fiscal policies.John Williams, the economist behind the website Shadow Stats, has done us the favor of stripping out the government gimmicks in order to derive the true inflation rate over the past thirty years. Using his SGS-Alternate Consumer Inflation Measure, gold would need to reach $8,890 per troy ounce and silver would need to reach $517 per troy ounce to match the highs from January of 1980. Seeking Alpha

I like to use multiple measures of Gold’s value relative to other assets such as property, oil, stocks and wages. I have covered each of these ratios on the blog previously providing potential targets for Gold and Silver based on ratios at which the metals have peaked in the past (of course there is no guarantee the metals will reach such an overvalued stage again, but I think given the crisis in confidence we are likely to see as a result of central bank printing that we will see some very similar ratios to those seen at the peak in 1980):

Political / Energy Crisis to Drive Gold Higher? (Gold/Oil Ratio)

Australian Houses: Gold / Silver Ratio – June Update

AUD Gold Price Exceeds Weekly Aussie Wage

DOW:GOLD ratio at new lows (6.5 to 1)

Some of the targets in these posts may seem unreal, but in my opinion any are possible should this bull market reach a point it goes parabolic (as most bull markets do). In the final 2 months of the bull market into January 1980 the price of Gold doubled and then fell back quickly, a volatile peak may come quickly and give you little chance to sell, so in my opinion selling at several levels on the way to where you think Gold will top out is a good idea as opposed to assuming you will be able to catch the exact peak.

Australian Perspective

As I said in a recent post:

Recent

strength in the Australian Dollar is partly a result of recent central

bank diversification into the Australian Dollar (such as these instances

reported on MacroBusiness: Czech Republic, Germany),

as well as investors seeking exposure to one of the (seemingly)

strongest economies (for now) around given the slowdown being

experienced in most other developed countries.It’s

unlikely that the Australian Dollar will trade above resistance of

$1.11 against the USD and it’s more likely to trade lower as our two

speed economy continues to take it’s toll on the larger populace. So in

my opinion there is limited upside for the Australian Dollar which

reduces the potential for the AUD/USD exchange rate to influence the AUD

price of Gold lower.

In my opinion the Australian Dollar is heading lower in the years ahead, regardless of the Fed policy to print. The trigger for a lower AUD might be rate cuts from the RBA or data showing weaknesses in our economy or banking system as house prices continue their slow melt.

The Pascometer has once again burned bright red as Michael Pascoe opened his mouth about Gold last week:

What we do know is that open-ended quantitative easing will continue to weaken the greenback, something that delights gold bugs and depresses Australian exporters of good denominated in US dollars – which is most of the key stuff.

Gold bugs talk about their yellow metal being an inflation hedge, or a deflation hedge, or whatever excuse is current, but the 2.2 per cent jump in gold prices overnight was all about the on-going debasement of the US currency. The Federal Reserve pumping out greenbacks means an increase in supply when there’s no particular increase in demand, therefore pushing down the price. SMH

Is Pascoe’s Gold negativity going to once again market a major low point? Gold has already rallied from a low of just above AUD$1500 to almost AUD$1700, so this Pascoe article wasn’t timely enough to catch the very bottom, but I suspect looking back in 6-12 months the price will be well higher and have rallied on much more than US currency debasement.

Mining Stocks

|

| HUI:GOLD Ratio shows Gold mining stocks undervalued |

|

| HUI Strong rally from late July lows |

Final Words

2012-09-17 06:05:55

Source: http://www.bullionbaron.com/2012/09/saddle-up-for-bubble-phase-in-gold.html

Source: