| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

It’s Getting Ugly

The declining state of the economy, as I’ve been explaining for a while now, is starting to finally manifest in economic and financial reports. As most of you know, corporate earnings for the 3rd quarter have been pretty dismal, with lots of earnings “misses” occurring.

Second, the Government released its “income statement” for the month of October, the first month of the Govt’s Fiscal Year 2013. It showed a $120 billion deficit, substantially higher than was expected and estimated and higher than October 2012′s $98.5 billion. Here’s the LINK The Government is saying “technicalities” led to a higher deficit. But the OMB didn’t seem to know about those technicalities when it projected a $113 billion deficit a couple of weeks ago. Where were these seasonal “technicalities” last year? I smell an accelerating spending deficit coming, which means more printing!

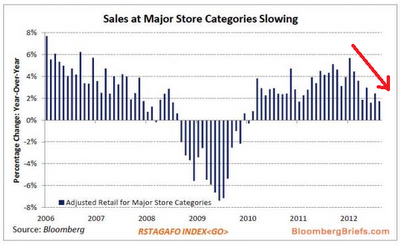

Also, retail sales for October were reported this morning and, not only did the headline number “miss” expectations, but the monthly print was negative – a sequential decline from September. The Obvious “explanation” for this is Hurricane Sandy. But the Government statistical geniuses typically make adjustments to smooth irregularities like that out of the number AND one would have expected to see a pop in retails sales, as areas expecting to be affected would have experienced a “run” on groceries, hardware items and propane. That excuse does not fit. Nevertheless, below is a chart sourced from Zerohedge, with the data sourced from Bloomberg, which shows monthly retail sales:

Finally, I know I’ve been threatening to post a big report on the housing market, showing its impending demise. I have been collecting data for this and it will take some time to write something meaningful. Since I don’t get paid to write this blog, I need to find the time – I’m hoping some time in the next week. What I can say is that, based on looking at the data I’ve compiled already, the “under the hood” data for the housing market is startlingly weak. I say “startlingly” because the Fed has driven mortgage rates to record lows, the banking industry in conjunction with the Government has prevented a lot of the “shadow inventory” from hitting the market and the Government has rolled out, thru FHA, a massive mortgage purchase and refinance program which is a “sub prime” quality lending program designed to try and really stimulate “organic”/primary residence purchases. All of those measures combined have barely stimulated a “bounce” in the numbers and the market is getting ready to do another big cliff-dive. To be continued…

With respect the Government’s spending and debt accumulation situation, I fully anticipate that some way, somehow, after a lot of political grandstanding and accounting chicanery, an agreement to kick the fiscal deficit can down the road will be reached. We already know that the Democrats in the Senate, via Harry Reid’s comment last week posted above on the right side of this blog, plan on asking for a $2.4 trillion bump in the Treasury debt limit ceiling. That tells you right there we can expect a deficit of at least $2 trillion for FY 2013. My personal view is that the politicians in DC do not have the mettle required to let the “fiscal cliff” event occur – neither does the President, nor would Romney have either for that matter. As history has shown time and again, the Government will spend and print until the currency ultimately collapses…

2012-11-14 18:02:41

Source: http://truthingold.blogspot.com/2012/11/its-getting-ugly.html

Source: