| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Merk Gold and Currency Outlook

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

merkinvestments.com / By Axel Merk / April 16th, 2013

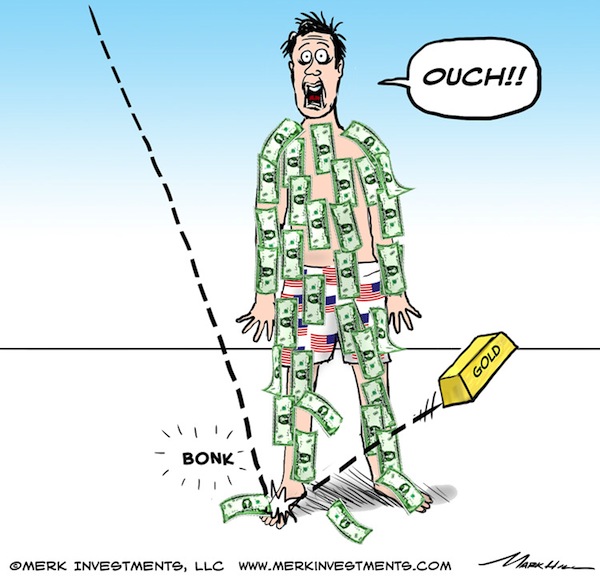

Anyone who’s ever had a brick fall on one’s feet knows how much it can hurt. It’s little consolation if that brick is made of gold. What’s happening to the price of gold? And has our outlook changed, be that for gold, the U.S. dollar or currencies more broadly?

With regard to gold, the primary change is in its price. That’s not a very good reason to be more positive or negative on the fundamentals of the yellow metal. Since the market appears to be in a “glass half-empty mood”, let’s list some of the negatives:

- China’s GDP growth has slowed to 7.7%, ushering in an era of more modest growth. In the past, disappointing growth numbers out of China have, on occasion, been a negative for the price of gold, as well as broader “risk sentiment”.

- Indeed, as European Central Bank (ECB) President Draghi has recently pointed out, the reason the ECB isn’t printing more money is because other central banks have shown that it doesn’t work. For the time being, the market appears to agree: the printing presses have not achieved a great deal, as exemplified by lackluster growth in the developed world. Indeed, we have pointed out many times that the biggest threat we might be facing is economic growth. That’s because once the money that’s been “printed” starts to “stick”, then deficits start to matter as bond markets throughout the world might sell off.

- The Eurozone has not fallen apart, and rampant inflation has not taken hold. Sure, certain prices have skyrocketed, but overall, the market as a whole is rather complacent. As such, it’s only reasonable for gold to take a breather.

- There’s a lot of “exit” talk at the Federal Reserve (Fed) with even doves calling for a phasing out of purchases towards the end of the year. Never mind that a “phasing out of purchases” is not an exit. As we discussed in our recent analysis “Fed Exit – What Exit?”, much of this talk might be wishful thinking. Surely the Fed would like to go back to a more normal environment, but recent disappointing data, such as disappointing nonfarm payroll and retail sales reports show that such talk might be premature. Still, forward looking markets might start to price in that “at some point” there may be an exit from the highly accommodative monetary policy.

Thanks to BrotherJohnF

2013-04-16 13:45:06

Source: http://silveristhenew.com/2013/04/16/merk-gold-and-currency-outlook/

Source: