| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

11/1/2015: Ending 2014 with a Bang: Russian Inflation & Ruble Crisis

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

trueeconomics.blogspot.com / by Dr. Constantin Gurdgiev / Sunday, January 11, 2015

Couple footnotes to 2014, covering Russian economic situation. Much is already known, but worth repeating and tallying up for the full year stats.

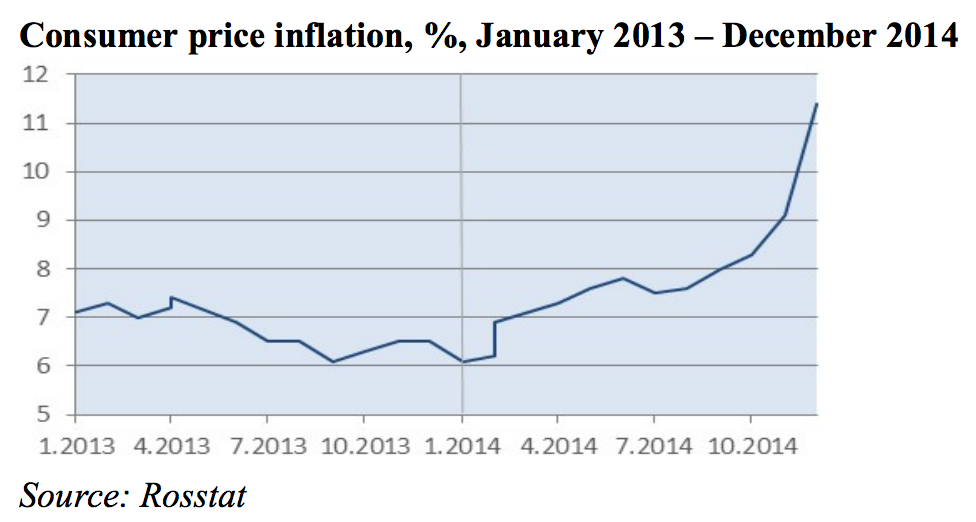

Ruble crisis with its most recent up and down swings took its toll on both currency valuations and inflation. Over 2014, based on the rate tracked by the Central Bank of Russia, the ruble was down 34% against the euro and 42% against the USD. The gap reflects depreciation of the euro against the USD.

Virtually all of this relates to one core driver: oil prices. In 2014, Brent prices lost 48% of their values and Urals grade lost 52% of its value. Urals is generally slightly cheaper than Brent, but current gap suggest relatively oversold Urals. It is a bit of a ‘miracle’ of sorts that Ruble failed to completely trace Urals down, but overall, you can see the effect oil price has – overriding all other considerations, including capital flight and sanctions.

The post 11/1/2015: Ending 2014 with a Bang: Russian Inflation & Ruble Crisis appeared first on Silver For The People.

Thanks to BrotherJohnF

Source: http://silveristhenew.com/2015/01/11/1112015-ending-2014-with-a-bang-russian-inflation-ruble-crisis/