| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Huge Capital Raising Effort at Spanish Bank Passing Latest Stress Test; New Game in Town; Smell Test Failure

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

globaleconomicanalysis.blogspot.com / Mike “Mish” Shedlock / Saturday, January 10, 2015 4:11 PM

Spanish bank Banco Santander was halted on Thursday, followed by an announcement it would raise capital. When the bank reopened its shares plummeted as much as 14%, with the Spanish stock market down about 4%.

Banco Santander passed the last “stress test” so allegedly it had no need to raise capital.

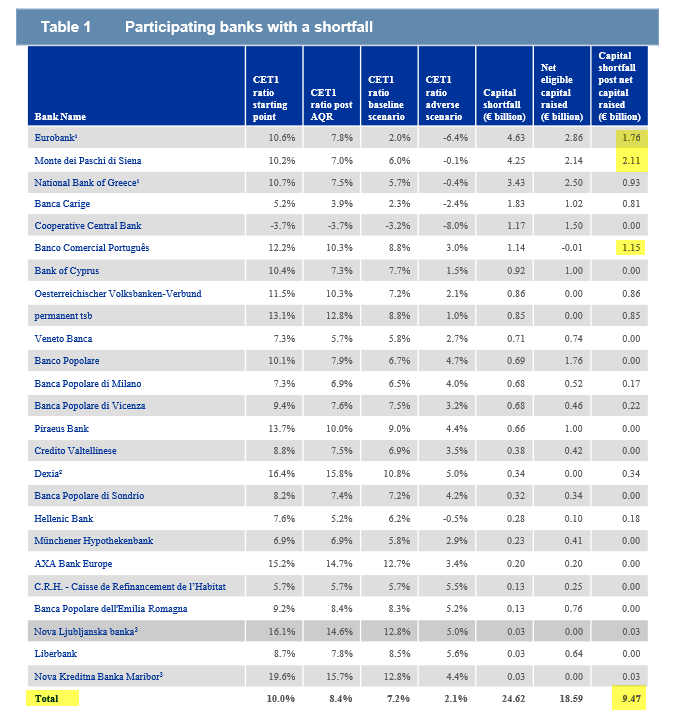

With that thought in mind, let’s recap the ECB’s love affair with stress tests that seldom find much need to raise capital.

On June 22, 2012, I commented Laugh of the Day: Stress Tests Show Spanish Banks Only Need Between €16bn and €62bn in New Capital; ECB to Accept BBB- Rated Debt (One Step Above Junk) as Collateral.

In October 2013, after two previous stress tests blew sky high, ECB president Mario Draghi announced that he would not hesitate to fail banks in the third test.

The post Huge Capital Raising Effort at Spanish Bank Passing Latest Stress Test; New Game in Town; Smell Test Failure appeared first on Silver For The People.

Thanks to BrotherJohnF

Source: http://silveristhenew.com/2015/01/10/huge-capital-raising-effort-at-spanish-bank-passing-latest-stress-test-new-game-in-town-smell-test-failure/