| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

What ‘Escape Velocity’? December Business Sales And Inventories Repudiate The Money Printers’ Myth

davidstockmanscontracorner.com / by David Stockman •

It is plain as day that massive central bank money printing and perpetual ZIRP do not rejuvenate the main street economy under conditions of “peak debt”. And the reason is so obvious that only Keynesian economists can’t grasp it.

To wit, if the balance sheets of households and businesses are tapped out—–then artificially suppressing interest rates cannot induce them to borrow even more money. Accordingly, spending is constrained to what can be funded from current income and cash flow after any set aside for new savings. In contrast to the four decades of the great credit expansion between 1970 and 2008, therefore, GDP can no longer be stimulated by incremental outlays derived from hocking household and business balance sheets.

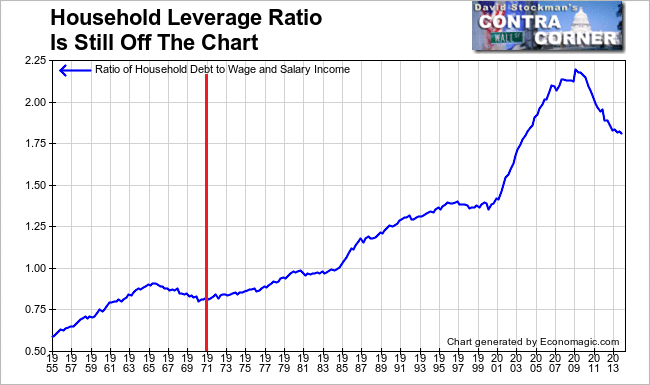

The graph below of the long-term trend of household leverage—measured as total mortgage, credit card and other consumer debt compared to wage and salary income—–demonstrates the new normal. During the long period of credit expansion, the Fed’s resort to low interest rates to stimulate borrowing and spending worked because households started the period with relatively clean balance sheets. As a result, central bank monetary stimulus caused leverage ratios to be ratcheted higher and higher in response to each round of rate cutting.

Self-evidently that ratcheting process has stopped, and household leverage ratios have fallen, albeit to levels which are still aberrantly high by historical standards. What this means is that after the peak debt inflection point was reached, the constraint on borrowing would not be the interest rate, as had been the case during the great credit inflation, but the availability of income to leverage.

The post What ‘Escape Velocity’? December Business Sales And Inventories Repudiate The Money Printers’ Myth appeared first on Silver For The People.

Source: http://silveristhenew.com/2015/02/13/what-escape-velocity-december-business-sales-and-inventories-repudiate-the-money-printers-myth/