| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Taking Delivery: Bullion Capital’s MetalDesk 2 Platform

Sunday, May 24, 2015 1:47

% of readers think this story is Fact. Add your two cents.

Physical bullion has been a pretty solid focus of this site since it’s inception almost 5 years ago. While I have in the past traded various “gold” and “silver” products (such as CFDs) which aren’t backed by physical, my personal exposure to precious metals at the present time is only to personally stored physical (via safe deposit boxes) and allocated bullion products, the most recent of which has been Bullion Capital’s MetalDesk.

I reviewed the platform a few weeks ago (Review of Bullion Capital’s MetalDesk 2 Platform) and promised a follow up on the delivery process (once I’d been through it personally):

“Once I put through each order I received emailed invoices instantly confirming the trades and information about delivery timing (in my case just over 2 weeks) of the bullion to my chosen vault location (Adelaide). Delivery occurs in a trade cycle allowing Market Makers and Liquidity Providers the ability to amalgamate orders over a 2-week period and deposit larger quantities into the vaults at one time.

I intend on taking delivery of these coins through the Bullion Capital platform, so that I can further review the process for readers (so watch out for part 2). Delivery comes at a cost of an additional $30 or 1% (greater of), plus associated freight and logistics charges. Withdrawal requests can be submitted on the MetalDesk trading platform under the ‘Transfer’ section and are processed within two working days. The bullion can be delivered to the clients business address (client pays delivery charges) or client can pick up from the vault (not available in Australia, due to Armagaurd policies). Delivery fees vary based on the amount of metal, a small amount can be sent by insured post ($30-50), a large amount can be delivered by an Armaguard truck and bodyguards who can deliver to any CBD address for approximately $150.”

So here is how it works…

With your bullion purchased through the platform, it will be available for delivery (to you, assuming you don’t want it stored and insured through their network of vault locations) once it has been delivered to your vault of choice. On a two week trade cycle and with liquidity providers having a further week to meet their bullion delivery obligations (depositing bullion into the Bullion Capital Vault Network), it may take (up to) three weeks from the date of purchase before it’s available.

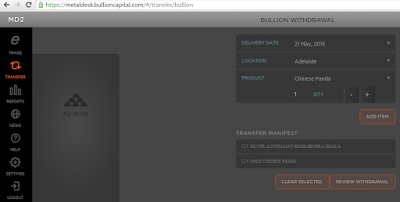

Once your metal is available to take delivery you will be able to check the transfers screen (under bullion) and select your products for delivery:

After reviewing your items for withdrawal and confirming you wish to proceed the message shown on the site indicates Bullion Capital will be in contact to process your request.

Soon after requesting the withdrawal I was phoned by the team at Bullion Capital to organise the delivery. In my case I was told the best option was secure delivery by Armaguard, rather than through Australia Post (which was usually an option for smaller deliveries). This was due to the policy of the local Adelaide vault who request standard delivery fees along with cost of Australia Post in order to process, it was cheaper to just have the secure delivery occur directly (in some cases the vault provider may post the bullion at cost through Australia Post). So delivery came at a cost to me of $100 (+ the $30 minimum fee from Bullion Capital, which is 1% if withdrawing in excess of $3,000 worth of bullion).

The coins I received were a roll of 2012 1oz Silver Perth Mint Kookaburras and a 1986 1oz Gold Chinese Panda. Despite my confidence in it’s legitimacy I had the Panda tested (by XRF, which can read metal content through the sealed plastic sleeve) and it was confirmed to be Gold, Au, the real stuff.

Despite the higher than expected delivery cost I still ended up well in front in this particular case (compared to buying from a bullion dealer) due to the age and higher value of the coins I was shipped. Breaking it down I paid (including all fees, in Australian Dollars):

20 x 2012 1oz Silver Perth Mint Kookaburras, $588 (+ $65, half delivery cost)

Total: $653

1 x 1986 1oz Gold Chinese Panda, $1599 (+ $65, half delivery cost)

Total: $1664

Grand Total: $2317

If I wanted to buy these coins from a dealer I would be looking at $35.60 per coin ($712/roll) for the 2012 Kookaburras (cheapest I could find), plus postage, totaling roughly $730. The 1986 Panda would be more difficult to source, but if I went with APMEX in the United States I’d be looking at $1720 (US$1347) for the coin plus postage, totaling at least $1750 (if I ignore the fact I’d probably be slugged exchange rate fees, a processing fee by customs and may need to fight for it’s GST free status). Grand total of this would be $2480 ($163 more than through Bullion Capital).

As I pointed out in the previous review, you do not get to select the specifics (e.g. year) of the products you have delivered so if you get lucky as I did you might be better off having purchased and had bullion delivered through MetalDesk, but you shouldn’t expect that to be the case. If I’d had a 2015 Panda and Kookaburras delivered I would have been worse off than having purchased through a competitive dealer (only slightly).

That said, taking delivery of the metal was only an exercise in seeing how this platform works. The real value is in the ease of buying, selling and storing allocated physical metal of different types. In normal circumstances you’d probably take delivery of a more substantial amount which would reduce delivery fees or leave it stored safely and insured with the option for delivery only in exceptional circumstances.

Bullion Capital‘s MetalDesk does fill a niche and what it does, it does well. If you are looking for allocated storage, with a various range of bar and coin types available, with pricing in Australian Dollars and/or US Dollars, where your purchased metal is stored, insured, in a choice of vaults around the country/globe and with the ability to take delivery of your metal in small or large lots, then I’d highly recommend you take their platform for a test run:

—

I’m sharing links and opinions daily on Twitter (@BullionBaron).

Source: http://www.bullionbaron.com/2015/05/taking-delivery-bullion-capitals.html