| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

16/10/15: IG Conference: Markets Outlook

trueeconomics.blogspot.com / by Constantin Gurdgiev / October 16, 2015

My speaking points on the topic of the Markets Outlook for yesterday’s IG conference:

Short themes:

Theme 1: Markets pricing in advanced economies:

– EV/EBITDA ratios signal overvaluation;

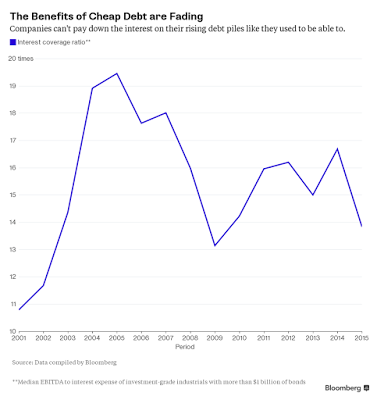

– EBITDA/Interest Expenses ratio is at below 2010 levels (below 14%) despite extremely cheap debt.

A handy Bloomberg chart:

– Global debt cycle has turned – sovereigns are not leveraging as fast or deleveraging, but corporates leveraged up.

– Much of pricing today reflects migration from equity to debt

– In this environment – long only allocations are problematic.

Theme 2: Emerging markets, especially BRICS

– Idea of 3rd Wave – Goldman’s thesis – is based on two drivers: duration of the crisis (‘this can’t be going for so long…’) and firewalls (‘this can’t spill into the developed economies…’) both of which are

– There are no fundamentals to support robust recovery view

– Again, allocations are highly problematic.

The post 16/10/15: IG Conference: Markets Outlook appeared first on Silver For The People.

Source: http://silveristhenew.com/2015/10/16/161015-ig-conference-markets-outlook/