| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

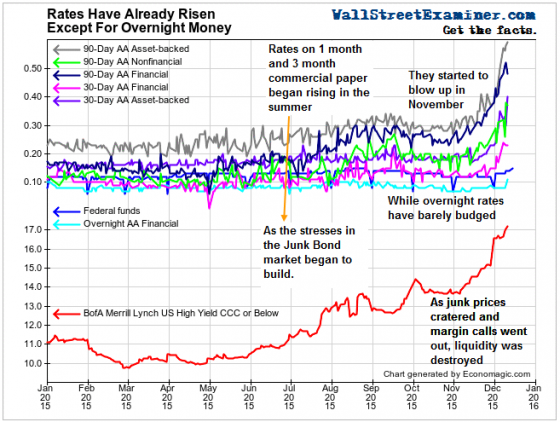

Interest Rates Have Already Risen, Except For Overnight Money

wallstreetexaminer.com / by Lee Adler /

With the Fed on the verge of making a rate move, Wall Street and big media pundits have missed the fact that rates have already moved. Various types of 30 day commercial paper has risen almost 20 basis points since October and nearly 30 bp since July. 90 day paper has risen by 25-30 bp since October and 30-35 bp since July. Meanwhile overnight money, which is the one area that the Fed purports to control, has barely budged.

In effect the market has already tightened. Signs of a money crunch are showing up in these soaring money market rates in durations longer than overnight. I have addressed the idea that the Fed probably could not make a rate increase stick, and the lack of movement in overnight financial company commercial paper as well as Fed Funds supports that. But there are clear signs of turmoil even in maturities as short as 7 days, and more so at 30 and 90 days. Apparently the Fed may not even be able to prevent a spontaneous self generated market tightening from spiraling out of control.

The post Interest Rates Have Already Risen, Except For Overnight Money appeared first on Silver For The People.

Source: http://silveristhenew.com/2015/12/16/interest-rates-have-already-risen-except-for-overnight-money/