| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

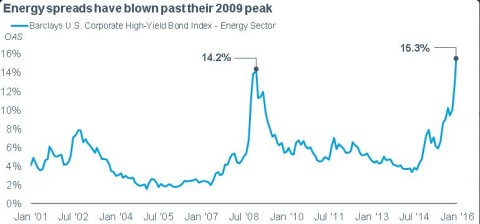

Mind The Junk In The Oil Patch—-Energy Bond Yield Spreads at 15.3% Now Exceed Great Recession Levels

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

davidstockmanscontracorner.com / By Ellie Ismailidou at MarketWatch /

Markets are pricing in a higher default risk for the energy sector than they did at the peak of the Great Recession, according to data from Schwab Center for Financial Research and Barclays.

As continued concerns about oil’s global supply glut pushed crude futures below $27 a barrel, sparking a global stock selloff, energy spreads surpassed their 2009 peak.

A spread is a yield differential between the index and comparable risk-free Treasurys. Widening spreads mean investors are pricing in more risk for the energy sector and require a higher yield as compensation for their risk.

As the following chart shows, the spread on the energy sector of the Barclays U.S. Corporate High-Yield Bond Index, a widely followed gauge of market-priced risk, reached 1,530 basis points as of Tuesday’s close, compared with 1,420 basis points reached during the height of the financial crisis seven years ago.

The post Mind The Junk In The Oil Patch—-Energy Bond Yield Spreads at 15.3% Now Exceed Great Recession Levels appeared first on Silver For The People.

Thanks to BrotherJohnF

Source: http://silveristhenew.com/2016/01/24/mind-the-junk-in-the-oil-patch-energy-bond-yield-spreads-at-15-3-now-exceed-great-recession-levels/