| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

18/2/16: Is the U.S. About to Slip into a Recession?

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

trueeconomics.blogspot.com / by Constantin Gurdgiev / February 18, 2016

In almost every sharp downshift in economic activity, and more frequently than that, in almost every economic recession, there are several regular predictors or leading indicators of tougher times ahead. These include sharp drops in corporate profits, and acceleration in yields on lower rated corporate bonds, usually followed by significant declines in industrial production indices and subsequent downward corrections in stock markets and services activities indices.

While these sequences of events repeat with regularity, in many cases, forward signals of recessions can involve a slight variation in timing and permutations of these shocks.

Another regularity that happens when it comes to business cycles is that, traditionally, the U.S. leads Europe into the downturn.

Trouble is, judging by all factors mentioned above, the U.S. is currently heading into a recession. Fast. And with some vengeance.

The Bad News

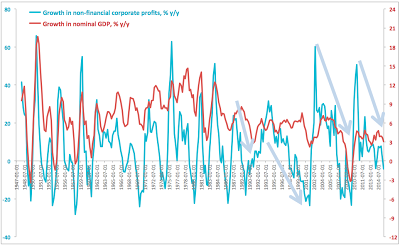

Let’s start with corporate profits. The latest data from the U.S. Federal Reserve shows that year-on-year 3Q 2015 growth in corporate profits for non-financial corporations was sharply negative – at -4.26 percent. Furthermore, corporate profits growth slowed down from 7.72 percent in 1Q 2015 to 1.83 percent in 2Q 2015. The rate of decline in corporate profits growth in the U.S. is now sharper than during the last GDP wobble in 1Q 2014 and sharper than in 3Q 2008. The latest growth figure also marks the fastest rate of decline in profits since 3Q 2009.

CHART 1: Non-Financial Corporate Profits and Nominal GDP

Growth Rates, Percent per annum

The post 18/2/16: Is the U.S. About to Slip into a Recession? appeared first on Silver For The People.

Thanks to BrotherJohnF

Source: http://silveristhenew.com/2016/02/18/18216-is-the-u-s-about-to-slip-into-a-recession/