| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Australia’s Bullion GST Fraud Still Under Wraps

Monday, February 15, 2016 3:26

% of readers think this story is Fact. Add your two cents.

More than two years after the Australian Federal Police initially reported serious fraud was occurring in Australia’s bullion industry we are yet to see any publicised progress on the investigation or action that has been taken.

In July 2014 there was an article from Chris Vedelago which provided details from two civil lawsuits in Queensland’s Supreme Court containing allegations involving a number of businesses in Australia’s precious metals market.

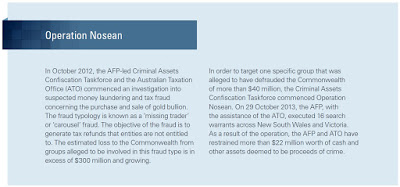

The AFP Annual Report for 2013/2014 briefly mentions the operation (Operation Nosean, no follow up is made in the 2014/2015 Annual Report):

An estimated loss to the Commonwealth of $300 million and growing, which I assume suggests the value of Gold funneled through this type of fraud to be in excess of $3 billion (figures likely higher now we’re a couple of years along).

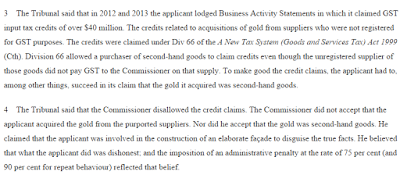

A recent Judgment in the Federal Court of Australia highlights another possible case of this fraud, with GST input tax credits of over $40 million claimed (relating to acquisitions of gold from suppliers who were not registered for GST purposes):

The problem with the lack of publicity around this industry fraud is that eventually a large number of private bullion investors/consumers could get caught in the crossfire should one of the companies involved be a retailer who gets shutdown by the ATO.

It was announced that the ATO would be provided additional resources in the 2015/2016 budget to tackle GST fraud:

The Government will provide $265.5 million to the Australian Taxation Office (ATO) over three years to extend the GST compliance programme.

While the Government recognises that most taxpayers do the right thing, the ATO will continue a series of compliance actions to make sure honest businesses have a level playing field. This programme will allow the ATO to continue to identify fraudulent GST refunds, under reporting of GST liabilities, failure to lodge GST returns and outstanding GST debts.

Here’s hoping those funds are used wisely, with those responsible held to account and in the meantime I would recommend if you are buying psychical bullion, you continue to keep your orders to a sensible level in case justice is served while you are mid-transaction:

“Limit the size of any single order with an individual or dealer to an amount you’d be prepared to lose if the deal goes sour.” – Bullion Baron

If you can provide any additional information on these investigations, you can email me: [email protected]

“Limit the size of any single order with an individual or dealer to an amount you’d be prepared to lose if the deal goes sour.” – Bullion Baron

If you can provide any additional information on these investigations, you can email me: [email protected]

—————————————————-

Source: http://www.bullionbaron.com/2016/02/australias-bullion-gst-fraud-still.html