| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

BOJ’s NIRP failure Triggers Doom-Loop In European Bank And Credit Markets

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

davidstockmanscontracorner.com / By Ambrose Evans-Pritchard at The Telegraph /

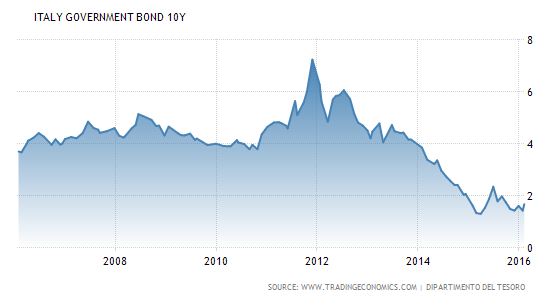

Credit stress in the European banking system has suddenly turned virulent and begun spreading to Italian, Spanish and Portuguese government debt, reviving fears of the sovereign “doom-loop” that ravaged the region four years ago.

“People are scared. This is very close to a potentially self-fulfilling credit crisis,” said Antonio Guglielmi, head of European banking research at Italy’s Mediobanca.

“We have a major dislocation in the credit markets. Liquidity is totally drained and it is very difficult to exit trades. You can’t find a buyer,” he said.

The perverse result is that investors are “shorting” the equity of bank stocks in order to hedge their positions, making matters worse.

Marc Ostwald, a credit expert at ADM, said the ominous new development is that bank stress has suddenly begun to drive up yields in the former crisis states of southern Europe.

“The doom-loop is rearing its ugly head again,” he said, referring to the vicious cycle in 2011 and 2012 when eurozone banks and states engulfed in each other in a destructive vortex.

The post BOJ’s NIRP failure Triggers Doom-Loop In European Bank And Credit Markets appeared first on Silver For The People.

Thanks to BrotherJohnF

Source: http://silveristhenew.com/2016/02/10/bojs-nirp-failure-triggers-doom-loop-in-european-bank-and-credit-markets/