| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

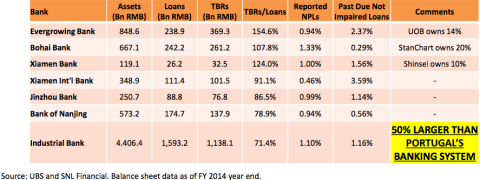

China’s Ticking Time Bomb—-A Runaway Banking System Bloated With Hidden Bad Loans

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

davidstockmanscontracorner.com / By Julia La Roche at Business Insider

Hedge fund manager J. Kyle Bass, the founder of Dallas-based Hayman Capital, has a warning about a “ticking time bomb” in the Chinese banking system.

Over the last ten years, China’s banking system has grown from less than $3 trillion to $34 trillion, equivalent to around 340% of Chinese GDP.

To put it in perspective, the US banking system had about $16.5 trillion of assets heading into the financial crisis, equivalent to 100% of US GDP.

“Credit has never grown faster or larger than it has in China over the past decade,” Bass wrote in a letter to investors dated February 10.

There is no precedent

“China’s banking system has grown from under $3 trillion to over $34.5 trillion in assets over the last 10 years alone. No credit system in history has ever attempted this rate of growth. There is no precedent,” he added.

Bass writes that Chinese banks have used wealth management products to accelerate this growth, and get around restrictions on lending.

According to Bass, Chinese banks are allowed to lend out 75% of their deposits.

The post China’s Ticking Time Bomb—-A Runaway Banking System Bloated With Hidden Bad Loans appeared first on Silver For The People.

Thanks to BrotherJohnF

Source: http://silveristhenew.com/2016/02/19/chinas-ticking-time-bomb-a-runaway-banking-system-bloated-with-hidden-bad-loans/