| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Get “Real” on Gold Fever

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

news.goldseek.com / By: Market Anthropology / 19 February 2016

As the yellow metal surged more than 5 percent last week, gold fever quickly broke out and captured the emotions of both speculators and spectators alike. Leading the clarion charge from the stands after the rally was none other than the former big-league slugger and soothsaying market strategist, Jose Canseco – who in his (or his accountant/social media manager’s) own words, tweeted – “With gold minus storage cost becoming greater than cash returns could be a long rally.”

– Contemplative pause –

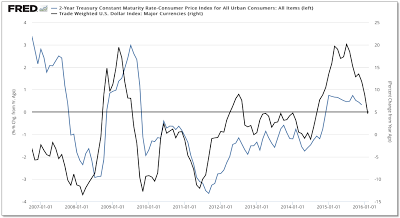

In a world more than ever flattened and converged in the discourse of ideas – both good and bad, who are we to deny the big man the public spectacle of pontificating on gold’s long-ball motivations? Granted, our thoughts on what fills gold’s sails here are a bit more nuanced, and perhaps not as succinct as Canseco appears to profess… But be that as it may, we’d frame it that as nominal yields fell sharply since the start of the year, inflation has fallen less. The net effect is that real yields (nominal yields minus inflation) have begun to fall – which historically is a sweet spot for gold to rally in.

This is the polar opposite dynamic of what transpired after the taper tantrum in May 2013, where nominal yields surged and inflation remained weak. And while St. Louis Fed President James Bullard (see Here) recently raised concerns that long-term inflation expectations may be falling – as the five-year/five-year forward breakeven rate and oil might suggest; we tend to agree more with his southern colleagues in the Atlanta Fed who quickly refuted Bullard’s anxieties the following day (see Here) with a clear description of why breakevens have correlated so tightly with oil and why long-term inflation expectations have remained stable over the past year.

Looking back at the cycle for perspective, real yields began to rise shortly after the US dollar and short-term yields troughed in 2011, and began a correlated ascent over the next several years (Figure XX). As the dollar strengthened with short-term yields, assets like gold and commodities became highly unattractive as inflation turned down and shorter-term yields rose. This critical differential created a “virtuous” market environment that strongly favored equities, as disinflation is generally a welcomed condition for stocks by boosting growth and price/earning multiples and kryptonite for commodities as investors chase securities with actual yields.

The post Get “Real” on Gold Fever appeared first on Silver For The People.

Thanks to BrotherJohnF

Source: http://silveristhenew.com/2016/02/19/get-real-on-gold-fever/