| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

2015 Caused An Earnings Rift, Too

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

davidstockmanscontracorner.com / by Jeffrey P. Snider •

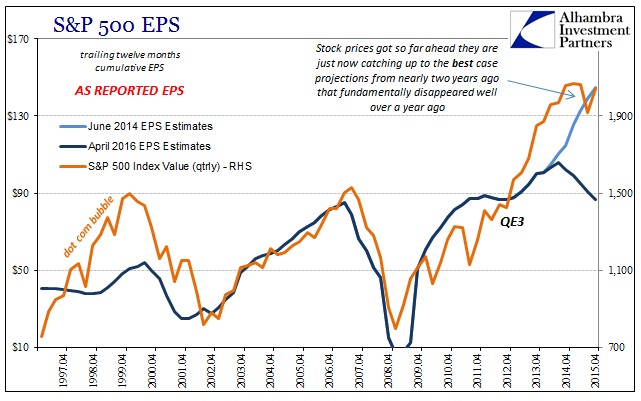

As the major stock indices overtake or threaten psychological round numbers again (S&P 500 2,100; DJIA 18,000), they have done so with the same problem as occurred in 2015. Stocks have been overvalued for some time in historical comparison especially after QE3 and QE4, but it was supposed to be in anticipation of the full recovery that QE would make. For the longest time, that narrative actually seemed plausible at least in earnings. In June 2014, analysts estimated that total as-reported earnings for the calendar year of 2015 would close out around $144 per share. At an index level of 2,100, it would represent a seemingly low valuation multiple of 14.5 (low because, we were told, low discounting from historically low interest rates, favorable fixed income comparisons, and then high expected growth especially in areas like tech and consumer-related industries).

Analysts’ estimates are always overly optimistic and have the hardened habit of being lowered as each particular quarter draws closer, but what happened with 2015 was something else entirely. Instead of $144 per share, 2015 ttm EPS for the index is going to be about $86.50. Rather than leave stock investors assured in their valuations, it meant the S&P 500 was trading around 24 times actual EPS. Worse, than that, the downdraft in earnings wasn’t apparent to analysts until it actually happened (believing in “transitory” as they did) and companies reported.

The post 2015 Caused An Earnings Rift, Too appeared first on Silver For The People.

Thanks to BrotherJohnF

Source: http://silveristhenew.com/2016/04/19/2015-caused-an-earnings-rift-too/