| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Canary On Sand Hill Road—-Q1 Startup Financing By VCs Drops 25%, Valuations Tumble

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

davidstockmanscontracorner.com / By Scott Martin at the Wall Street Journal /

Venture-capital investors hit the brakes on investing in the first quarter, following a funding bonanza the past two years that pushed valuations of once-hot technology startups to soaring heights.

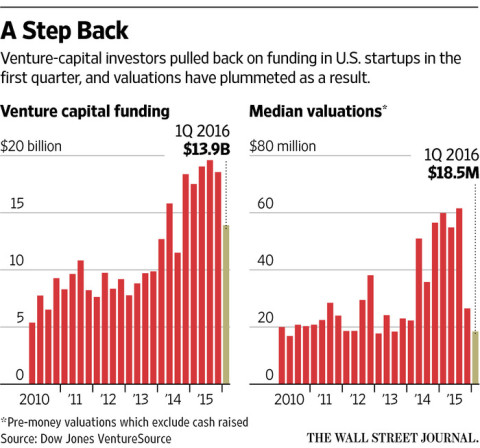

Funding for U.S. startups fell 25% from the fourth quarter to $13.9 billion, the largest quarterly decline on record since the dot-com bust, according to data from Dow Jones VentureSource. The numbers of deals also hit a four-year low of 884.

The drop threatens to hasten a slump rippling through Silicon Valley that is pushing startups to slash marketing budgets, lay off staff and dial back lofty ambitions. Investors such as mutual funds and big banks that pumped money into startups on the promise of big returns have since retrenched, as a punishing market for initial public offerings has spoiled the runaway optimism.

The sky-high valuations of last year have retreated as a result. In the first quarter, the median value of U.S. startups plummeted to $18.5 million after hitting a peak of $61.5 million in last year’s third quarter.

“I think investors are nervous, sitting on the sidelines waiting to see what happens,” saidBrian Mulvey, co-founder and managing partner at PeakSpan Capital, which recently raised a venture fund of $150 million.

The post Canary On Sand Hill Road—-Q1 Startup Financing By VCs Drops 25%, Valuations Tumble appeared first on Silver For The People.

Thanks to BrotherJohnF

Source: http://silveristhenew.com/2016/04/18/canary-on-sand-hill-road-q1-startup-financing-by-vcs-drops-25-valuations-tumble/