| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

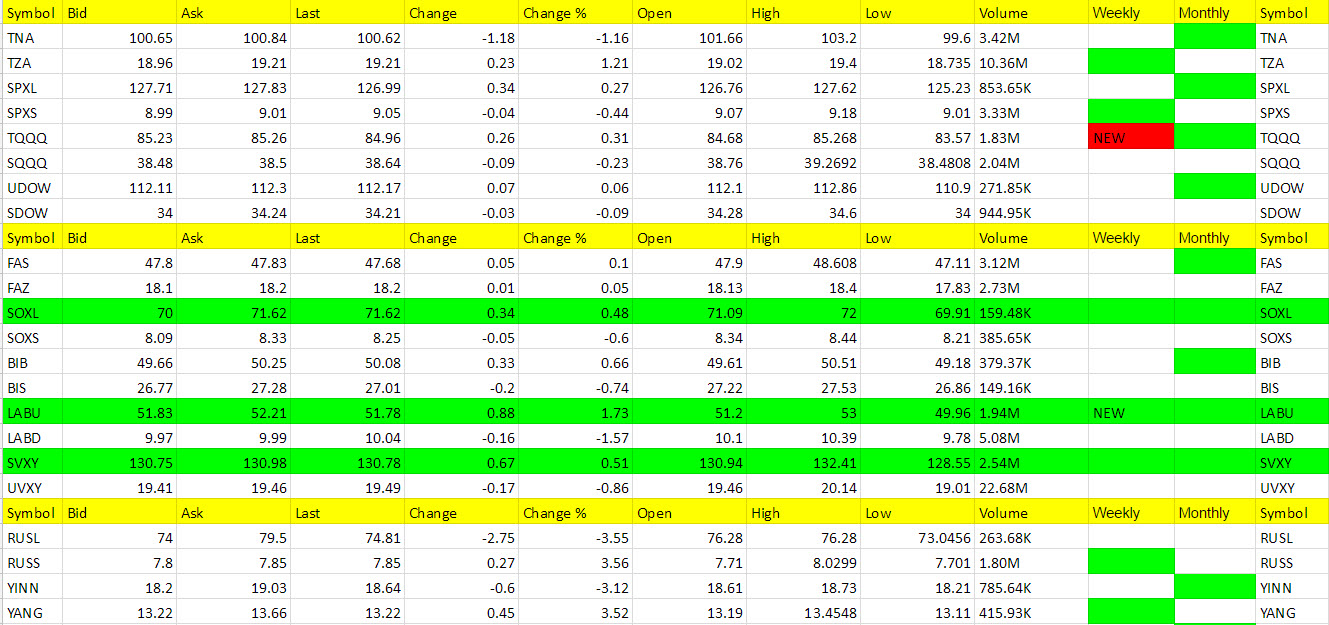

ETF Trading Research 3/9/2017

NOTE: The following is my nightly report for the ETF Trading Service subscribers and is a free sample to show exactly what our performance has been of late. It also will provide some detail on what’s going on with gold and silver. Some of you may think the returns are too good to be true. If so, try a 2 week free trial and see for yourself what’s real. The more I do this the more confident I am in its success. And for those that think I am spamming you with these results, that’s called capitalism and I’m not ashamed of self promotion, especially if I think it can benefit you. Read below for yourself and make investing great again!

ETF Trading Research 3/9/2017

JDST might have got you a couple trades today and maybe UVXY which we had sold in the morning for a little profit. We entered the new green EDZ which is up and I had us shy away from TQQQ and SOXL, but both were up early and SOXL was up today. TQQQ did turn red on the weekly immediately with that push lower.

We locked in our profit on some longs with RUSS in the morning at 10% for 1/2 per the rules and got 13% on the remaining half. We then sold our remaining 1/2 shares in DWT for 17%, DRIP for 19% and ERY for 11%.

We had entered and are still holding SDOW, TZA which are still up from entry along with YANG. Should have probably scalped SDOW though since it is not green on the weekly. I try to remember everything, but will slip now and then. If we are up, it’s not too much of an issue.

We were 1 out of 3 for UGAZ, but I think enough to be about even on the trades after the last one got us the tight stop outs back. I reminded you, as well as me, that UGAZ was not green on the weekly too. ;/

I didn’t mind lightening up as we started to bounce in futures as tomorrow we have the Unemployment data and who knows what can come from it with this crazy market. I did say I want to take some risk and hold JNUG and USLV overnight and into the report. I just thought the risk vs. reward was with us but I did call it a BOLD trade. Read about gold and silver below.

Economic Data for Tomorrow

It’s all about Nonfarm Payrolls tomorrow. If they miss, gold shoots up $50 and silver probably 75 cents. If they come in better than expected, it’s priced into gold I think and it might be sell the news. That’s why I have us long some miners which have reacted very well so far to this gold beat down. But dollar has to stay below 102.

http://www.investing.com/economic-calendar/

Stock Market

What a rebound in futures. Notice how they traded with oil today? Oil bounced and so did the market. I think the market is very weak and I am discounting the late run we got. I’m still willing to go long the market and LABU triggered so we’ll keep an eye on it tomorrow. The RyanCare is having some issues it looks like and the House is set to repeal Obamacare. Futures up 4.50 to 2370.75.

Foreign Markets

We took the money and ran on RUSS today. YANG and EDZ still doing well. Keep a close eye on them though.

Interest Rates

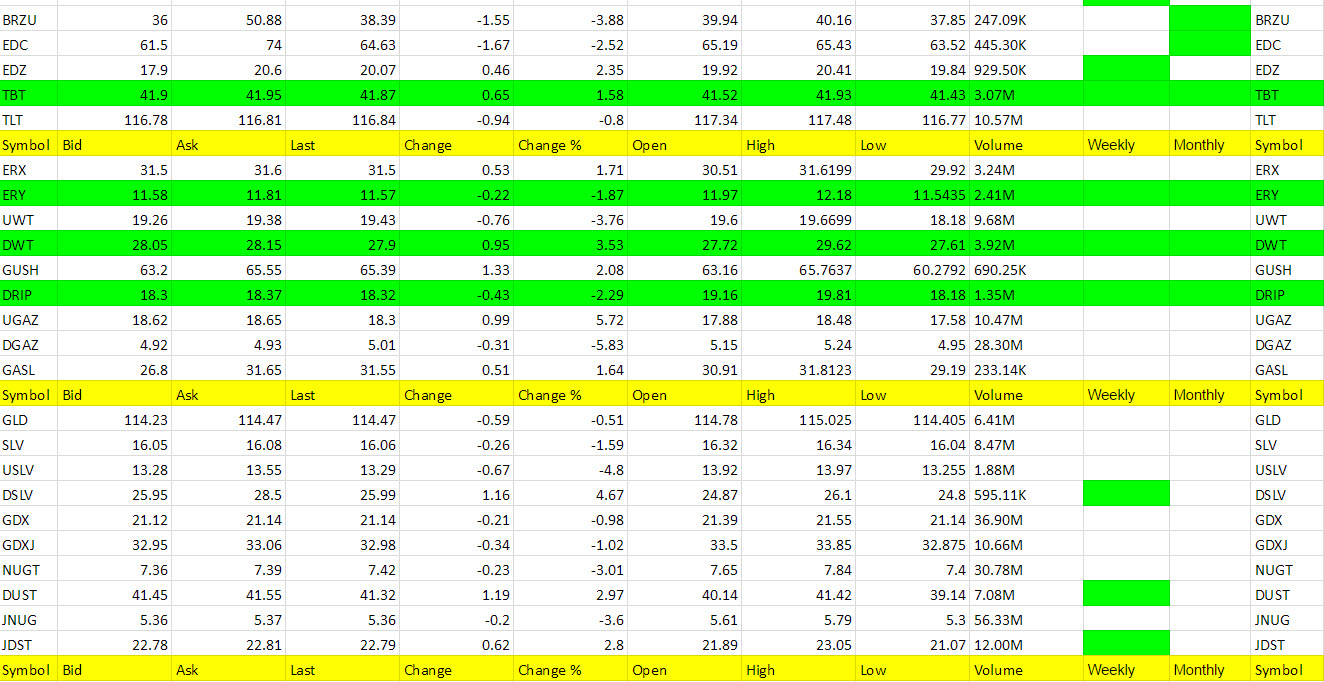

TBT still moving higher. I don’t mention it much because it’s such a slow mover as I said. Fed disappoints or Unemployment data bad, BUY TLT!

Energy

Only one word for DWT, ERY and DRIP; Heaven. We will still lean towards them but see if there is a further pullback first. We’ll trade them like we have JDST, selling quickly for profit and then looking for further upside.

UGAZ seems like it wants to move higher. We’ll still lean that way with our scalps until it turns green on the weekly.

Precious Metals and Mining Stocks

I kind of messed up in what I wrote in the report yesterday, lol. Must have been a long day and the last 48 hours have been. I will escape somewhere this weekend and rejuvenate, but I am trying to fight hard for you all. The Fed decision is the 15th and Unemployment data tomorrow. I think with both it will be sell the news and gold will move higher. That hasn’t stopped market makers from bringing gold down but so far they aren’t bringing JNUG down the last couple days.

Tomorrow will be interesting to say the least. We’ll hold, if you can handle some risk, the 1/2 shares of JNUG and USLV through the Unemployment report and possibly into the Fed if we can catch a break and move higher. Dollar lower is my main reasoning outside of JNUG holding up strong. I am going against the weakness in silver though. When gold and silver stop the selling, silver should pop up quicker. Dollar 101.96 and we need it to stay under 102 and fall quickly to under 101.70 then 101.63 and finally crash already. Gold is 1198 and under that 1200 level and silver 16.92 and under that 17 level. If market makers did their job right, it got those who thought those levels were psychological support, it got them to trigger sells and may continue to do so till the the Unemployment data tomorrow which should see some whipsaw action and we’ll see if it is sell the news time and a bounce for this badly beaten down sector.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UGAZ, DSLV, RUSS, DWT, YANG, DUST (3rd day for RUSS so probably a pullback – we rarely get 3 days in a row here and DSLV is on it’s second day so we’ll see if silver gets a bounce (USLV – 1/2 shares) – (LABU turned green on the weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DGAZ, USLV, UWT, BRZU, RUSL, JNUG, YINN, NUGT (have to keep an eye on the bold ones there for bounces, and we are in one of them; JNUG 1/2 shares. (TQQQ new red weekly)

Green Weekly’s

NOTE: Please look at the Percentage column next to the High Date and compare it to the Low Date and you get an idea of the risk vs. reward for these ETFs. You can see why I have the percentage higher for some in taking profit, and lower for others. But ask yourself one question; how many of these have you got stopped out of? Dennis Gartman I listened to years ago at an investment conference say he was wrong 80% of the time. When he was wrong, he kept a stop. When he was right, he let it ride. I don’t know what the percentages are of winners vs. losers since I had that 3rd party start tracking these ETFs, but I would like to think it’s better than 20%, lol. Obviously I am joking as I’d say it’s quite high. Hopefully this Service will continue to perform well for you. The only time you get in trouble with these ETFs is when you stay in one that is probably not green on the weekly any longer. Stick to the green weekly’s and profit. Simple as that. Also note we traded JDST many times for profit since it turned green on 2/27 and after taking that 1st day 10% profit on 1/2 shares and 7% on the remaining 1/2 shares.

Source: http://buygoldandsilversafely.com/gold/etf-trading-research-392017/