| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Mom and pop landlord nation: Small time investors pick up the slack left by large institutional buyers in housing.

doctorhousingbubble.com / February 28th, 2017

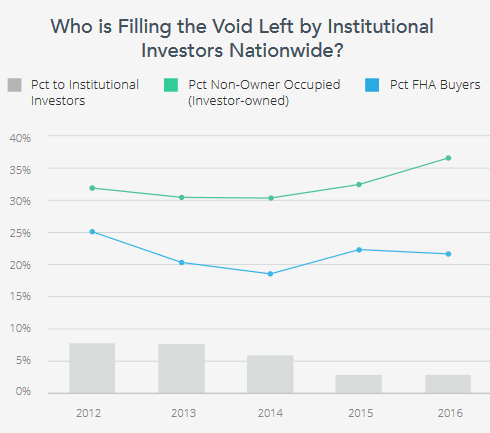

The bread and butter of any healthy housing market is having a good amount of first time home buyers. That is what drives new home building and also allows for the homeownership rate to go up. Most of the new household formation since the bubble burst was largely done through new rental households. Institutional investors pulled back from the market starting in 2014. Yet the homeownership rate continued to decline. So who stepped in to fill in this gap? Some of it was filled by first time buyers going in with low down payments thanks to FHA insured loans. But a large percentage was made up by mom and pop investors with a lust for HGTV and their dreams of becoming flippers or landlords. In most manias, once mom and pop are diving in with gusto you really need to think about what is going on. I know Taco Tuesday baby boomers are looking for a little “excitement” in their lives and putting habanero salsa on your Chipotle burrito isn’t going to cut it. So why not take the biggest risk by buying real estate when prices are near a new high?

The rise of the mom and pop landlord

Who knew rental Armageddon would be brought on by smiling and aging baby boomers? So we knew that institutional investors, those that buy at least 10 properties a year, had their fill of buying properties at a discount between 2009 and 2013. Essentially they were the only group with deep enough pockets (and bailouts) to buy up and amass a large portfolio of properties while others were getting kicked out of their homes and losing jobs. As institutional investors pulled back, mom and pop investors stepped in.

The post Mom and pop landlord nation: Small time investors pick up the slack left by large institutional buyers in housing. appeared first on Silver For The People.

Source: http://silveristhenew.com/2017/03/01/mom-and-pop-landlord-nation-small-time-investors-pick-up-the-slack-left-by-large-institutional-buyers-in-housing/