| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Precious Metals and 200-Day Moving Averages

The precious metals complex enjoyed a strong week mostly due to a post-Fed explosion on Wednesday. Although gold stocks sold off to end the week, they finished up almost 5% for the week. Gold gained 2.4% on the week while Silver gained 2.9%. The miners enjoyed massive gains following the previous two rate hikes and that has some optimistic about a repeat scenario. However, the miners and metals need to prove they can recapture their 200-day moving averages before we become optimistic.

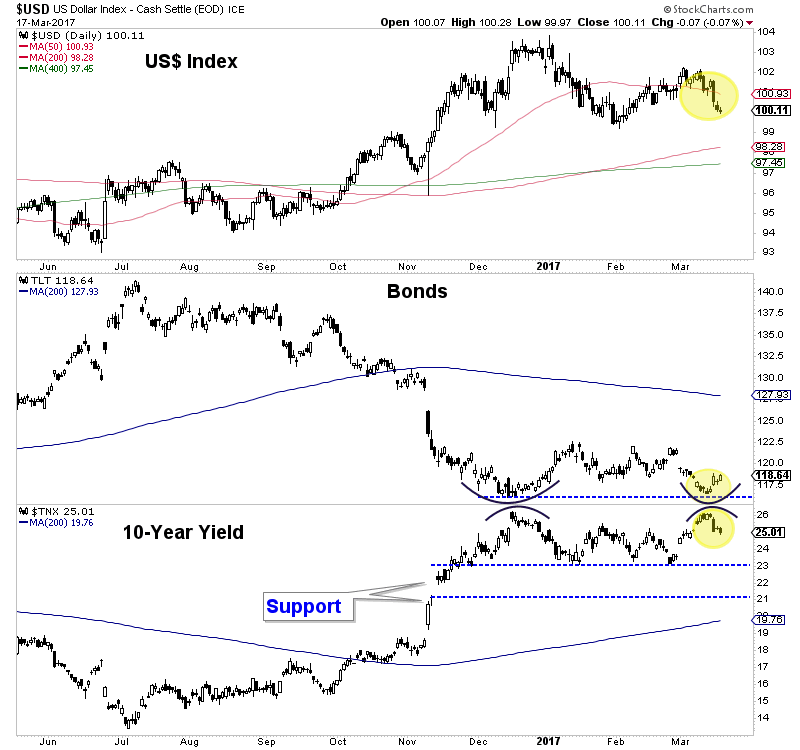

Precious metals should trend higher in the short-term if the current macro technical landscape does not change. The US Dollar index has fallen below its 50-day moving average and could fall another 2% to moving average support. Also, despite the Fed rate hike, the 10-year yield did not make a new high. Bonds could rebound and the huge speculative short position, if unwound could add to the rebound. A rally in Bonds coupled with a weak US Dollar would help precious metals.

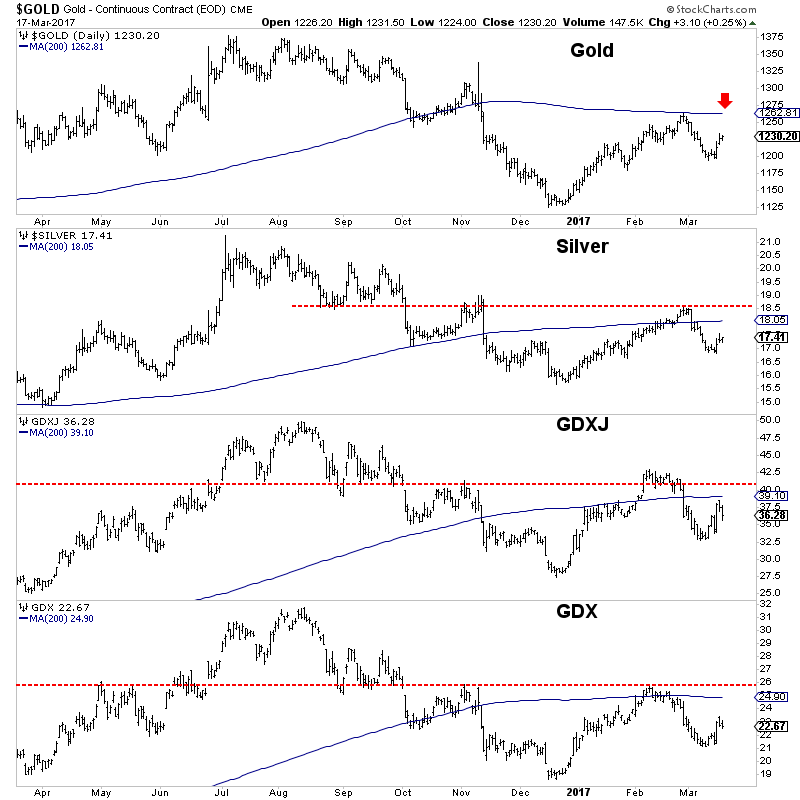

Precious metals could rebound farther but resistance in the form of the 200-day moving average looms large. In the chart below we plot Gold, Silver, GDXJ and GDX along with their 200-day moving averages. In addition to the 200-day moving average, the February highs will also provide resistance. We should note, while the metals remained above their late January lows, the miners did not. It would not be a good sign to see a continued rally led by the metals rather than the miners.

Precious Metals

We should see some upside follow through in precious metals if our read on the US Dollar and Bonds is correct but take note of February highs and 200-day moving averages as resistance. I would not be chasing any strength until the sector proves itself. The first step would be a return to the February highs. If this rally fades below those levels then miners are again at risk for a retest of the recent December lows. We continue to look for bargains that we can buy on weakness and hold into 2018. For professional guidance in riding this new bull market, consider learning more about our premium service including our current favorite junior miners.

Jordan Roy-Byrne, CMT, MFTA

Source: https://thedailygold.com/precious-metals-and-200-day-moving-averages/