| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

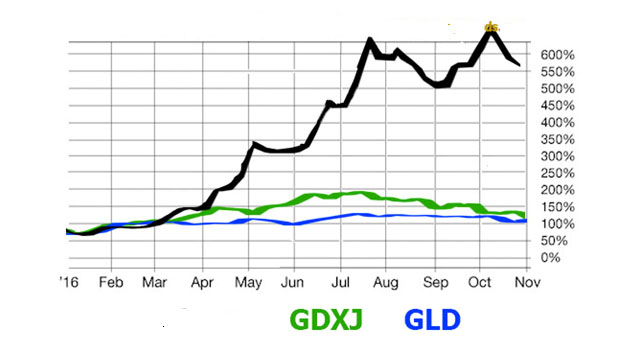

Doug Casey’s Big Gold Play Makes 3,100% More than Gold Bullion

Source: Lior Gantz for The Gold Report 04/09/2017

Lior Gantz of Wealth Resources Group discusses why he anticipates the majors will start making acquisitions of small-cap companies again and how investors can take advantage.

Most investors do not own gold and silver. In fact, most people worldwide don’t own a single ouncethey never have and probably never will.

Gold ownership is down to less than 1% of the population, and that is similar to not owning insurance.

Fiat currencies are simply vehicles for governments to run deficit spending without taxing the populationinstead, they simply issue more bonds. It’s working (for now) since there’s enough population growth to fund increasing tax revenues, which cover the interest payments on these fiat IOUs.

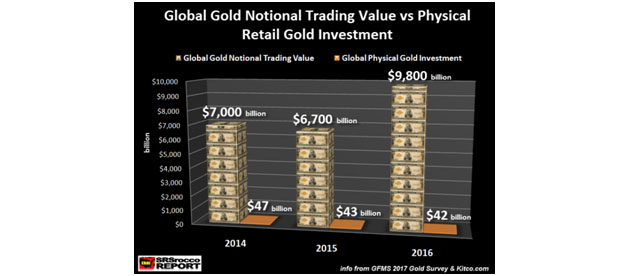

Like our friend at SRSrocco Report shows in this chart, the trading volume for gold rises tremendously every year, and that is how paper gold manipulation works.

As we showed on our micro-documentary, “Manipulation End-Game: JP Morgan Hoarding Silver,” the major banks are behind blatant paper rigging, which is keeping a cap on precious metal prices.

If you truly understand the role of these metals in a portfolio, you understand this is actually a blessing in disguise, because you can accumulate more before a potential fiat crisis sends these safe havens into much higher price levels.

With cryptocurrencies, you can actually make a fortune just by owning this new coin!

It’s a speculation, but allocating small amounts could yield huge gains.

For long-time international speculator Doug Casey, who is a long-time friend of mine, the best leveraged play for the bull market is, without a doubt, this stock.

It outperformed the GLD (SPDR Gold Shares), the GDXJ (VanEck Vectors Junior Gold Miners ETF) and the price of bullion.

The reason is it was able to buy all of its gold assets during the bear market at seriously depressed valuations in exchange for shares, as well as cash!

That is a power play, and its why this stock has been Doug Casey’s favorite for years.

It’s not just him, though. Rick Rule is involved, as well as the “best stock picker in mining,” Marin Katusa.

See, most of the major banks use the paper market to trade the ETFs, but once the desk managers at JP Morgan, HSBC, Barclays, and the other major banks realize that there’s more money to be made in the juniors than the ETFs, it is all but guaranteed that they will turn towards companies like Doug’s favorite.

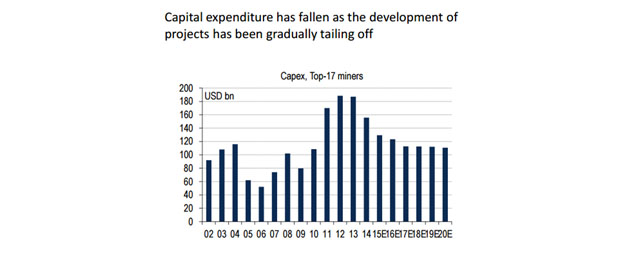

What the major banks are waiting for is capex stabilization, and that is happening right now.

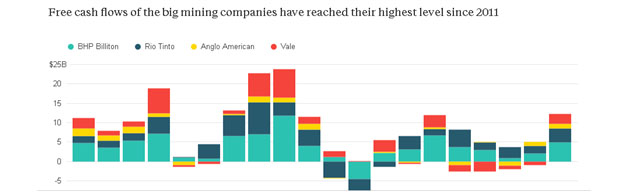

In fact, the major miners, like Rio Tinto, BHP Billiton, Vale and Anglo American are profitable again!

So, what does that mean to us?

Investment bankers, hedge funds and institutional money will buy the majors, as always, and begin to demand that they raise dividends.

They will start making acquisitions of small-cap companies to replace their depleting mines, and the retail investors, who were briefly bullish in 2016, will come back and fuel this sector.

My gut tells me that this stock, which I’ve been following for years, will be among those who break the 500% return levels.

Lior Gantz, an editor of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Lior Gantz: I, or members of my immediate household or family, own shares of the following companies referred to in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies referred to in this article: None. My company has a financial relationship with the following companies referred to in this article: GoldMining Inc. has a marketing agreement with Gold Stanfard Media. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor’s fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Charts courtesy of the author

Source: https://www.streetwisereports.com/pub/na/17379