| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Societe Generale: rates down by end of 2012 (CHARTS)

Mortgage rates aren’t directly tied to the 10yr Treasury note like many people think, They’re tied to Fannie and Freddie mortgage bonds (aka Agency MBS). Still, the 10yr Note is still a critical proxy for longer-dated rates in the U.S. economy, and that’s what most analysts use to communicate rate projections. The 10yr Note hit a low of 1.47% on June 1 and rates have been within .125% of record lows since then.

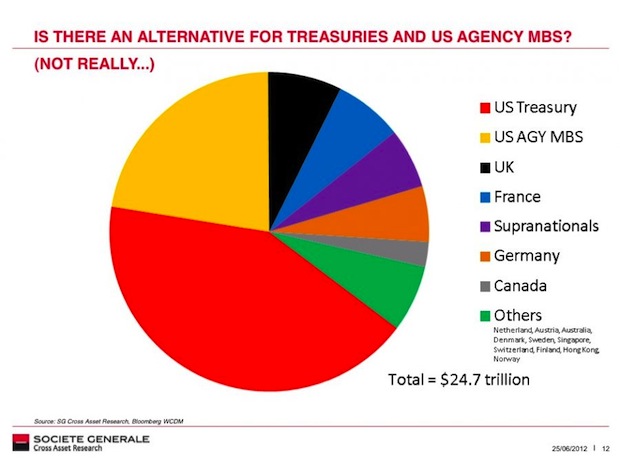

That brings us to the halfway point of 2012. What about the rest of the year? Below I’m excerpting a few rate slides from a Societe Generale U.S. economic outlook presentation that BusinessInsider posted today. The first one sums it up well: there’s really no safer alternative to Treasuries and agency MBS while global macroeconomic uncertainty persists. This ongoing demand drives (keeps) prices of these bonds up, which drives (keeps) rates down.

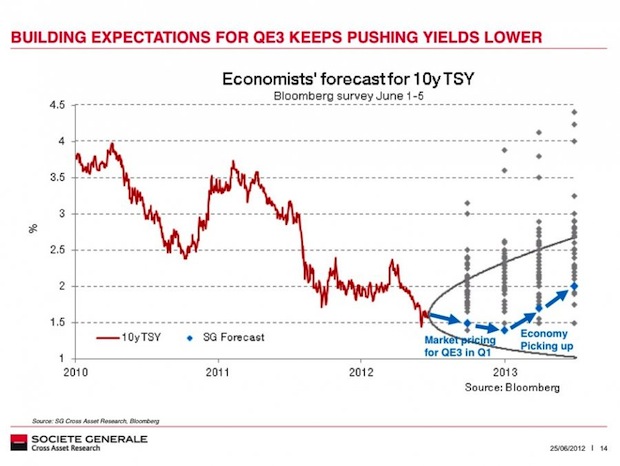

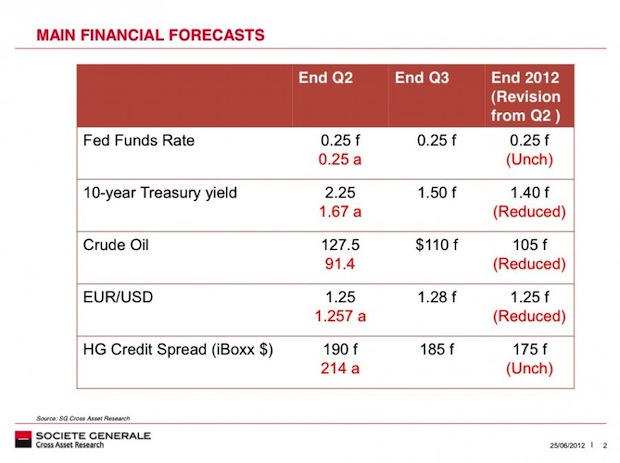

The other two slides show projections for the 10yr Note yield, which today is at 1.62%. Their outlook is for 1.4% by end of the year. This would suggest mortgage rates .125% lower, or perhaps .25% lower if the 1.4% level were sustained rather than just touched.

Reference:

SocGen U.S. economic outlook: SLIDES (BusinessInsider)

WeeklyBasis: Low Rate Complacency

$TLT $MBB $ZN_F $ZB_F $TNX $TYX

Source: