| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

No CNNMoney, Rates Didn’t ‘Smash’ Old Record

I know journalists tire of writing about Freddie Mac’s rate survey every Thursday, but CNNMoney’s rate piece (and headline) today was quite misleading for consumers.

I’ll chalk the headline up to editors rising up to the bar set by BusinessInsider. But you better at least have real information in the piece once that kind of headline pulls in a reader.

Freddie Mac reported that 30yr fixed rates dropped from 3.66% to 3.62%. That’s 4 basis points lower. Hardly a “smash” and not even enough to move consumer rates—because rates lenders offer to consumers move in increments of .125% (or 12.5 basis points).

And while I’m at it, let’s cover some other critical points about rates that CNNMoney and most other financial media miss when reporting on Freddie Mac’s Primary Mortgage Market Survey (PMMS) every Thursday:

- PMMS rates are national averages based on survey responses from 125 lenders—Freddie Mac surveys 25 lenders in each of their 5 regions.

- PMMS rates are for the week leading up to (and not including) Thursday. Mortgage rates are tied to mortgage bond trading, and as such, rates change all day everyday. So Thursday PMMS rates are long expired before they ever hit the media. Maybe the market has held by the time the press covers it, maybe not. The only way to know is with a quote from your lender based specifically on you and your property.

- PMMS rates are on Conforming loans up to $417,000. Super-Conforming loans up to $625,500 are excluded. Jumbo loans above $625,500 are excluded. Rates for these loan tiers above $417,000 are higher.

- PMMS rates are on Conventional loans, and exclude FHA loans.

- PMMS rates are for single family homes, and exclude other property types like condos and duplexes. Rates for these other property types are higher.

- PMMS rates are for borrowers with at least 20% equity in their homes.

- PMMS rates are for owner-occupied homes only. Rates for rental properties and (some) second homes are higher.

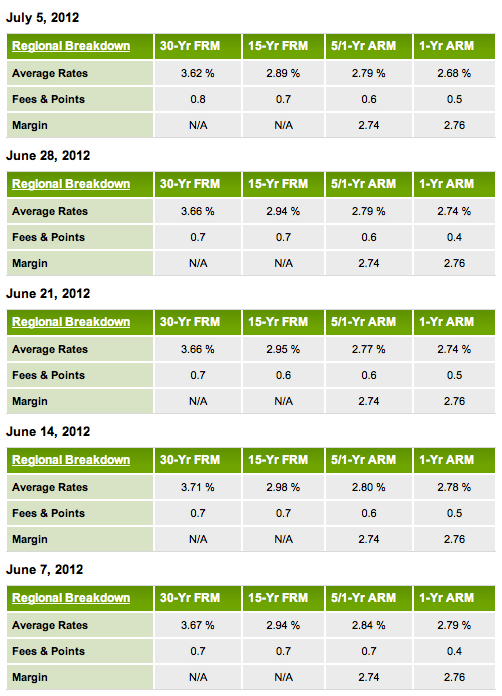

- PMMS rates always include “points” to buy down the rates. Many press reports (including today’s CNNMoney report) leave out this critical fact—it’s critical because rates with zero points are higher. Below is a table showing Freddie Mac PMMS rates and points (on single family home loans to $417,000) for the past 5 weeks.

So to CNNMoney, I’ll just say I tire of writing pieces like this too, but this is the real information consumers must know to make decisions. So step up with this level of detail and show the rest of the mainstream media how it’s done. If so, thousands more real estate pros will send your pieces to millions more consumers.

___

Reference:

- Mortgage Rates Smash Old Record (CNNMoney)

- Freddie Mac Weekly Rate Survey (THIS IS SOURCE MEDIA USES)

- How To Shop For A Mortgage (MortgageNewsDaily)

Source: