| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Janet Yellen Encourages More Risk Taking in Markets Tuesday

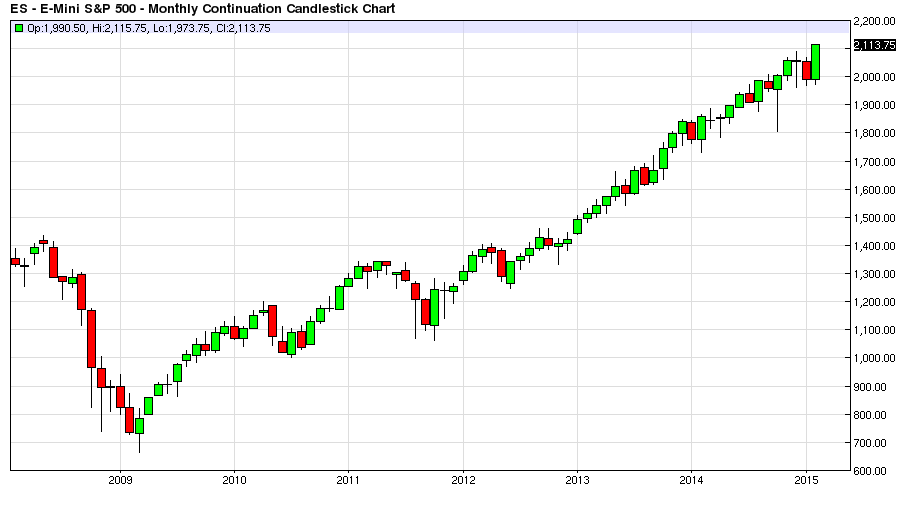

Dian L. Chu: Federal Reserve Chair Janet Yellen testified before the Senate banking committee on Tuesday, and again the end result from the market`s point of view was to borrow even more money, and buy risk assets in the form of bonds and stocks.

Dian L. Chu: Federal Reserve Chair Janet Yellen testified before the Senate banking committee on Tuesday, and again the end result from the market`s point of view was to borrow even more money, and buy risk assets in the form of bonds and stocks.

Bonds Have Become Speculative Risk-On Assets

When bonds go up when stocks go up, that`s all you need to know that under the Free Money Fed that Bonds have changed from being traditionally risk averse assets, or assets to hedge against risk during bad times or portfolio balancing, they have now become ultra-aggressive risk assets to buy just like stocks for price appreciation and yield chasing plays. How you can tell is by what other assets like the important funding currency crosses do, and today`s action just screamed borrow more money via the various carry trade crosses, and buy the risky assets like overpriced bonds and stocks because to the market Janet Yellen gave them the all clear for at least TWO MORE MONTHS.

What Yellen Said…and The Market Believed Anyway?

The ironic part is the market`s interpretation and what Janet Yellen actually said is such a large gap that you could float and iceberg through it. She said the Fed will most likely not raise rates for two more Fed meetings (March and April) the market interpreted this as no rate hikes for 2015!

Read More: The Swiss 10-Year Bond Illustrates Central Banks` Flawed Monetary Policy

June (25 Basis Point) Rate Hike 95%

It is interesting that Janet Yellen is starting to discuss elevated financial metrics in financial markets, but yet at the same time not be aware of how her actions and statements are interpreted as far more dovish than her literal statements, nothing she said today postponed a June Rate Hike, in fact, if anything it looks like that June Fed Meeting is when the first rate hike will occur, being that it is a quarterly meeting with a formal press conference attached.

You are viewing a republication of Market Daily News content. You can find full Market Daily News articles on (www.marketdailynews.com)

Source: http://marketdailynews.com/2015/02/25/janet-yellen-encourages-more-risk-taking-in-markets-tuesday/