| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Using Energy To Gain Valuable Insight On Stocks

Chris Ciovacco: Key Levels For Energy Bulls And Bears

Chris Ciovacco: Key Levels For Energy Bulls And Bears

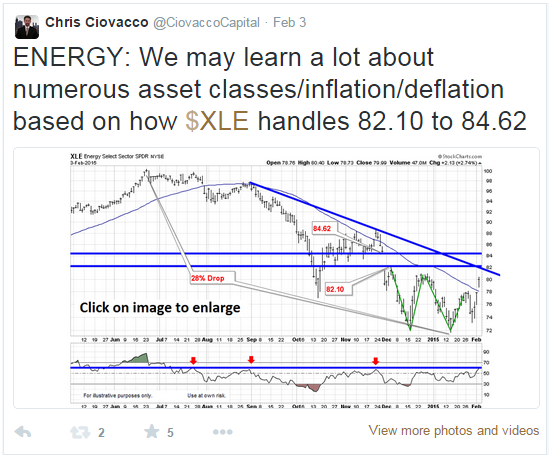

In a February 3 tweet (below), we noted market participants could gain some valuable insight into economic dynamics by keeping an eye on energy stocks (XLE).

Thus far, energy stocks have been unable to break the 82.10 level noted two weeks ago.

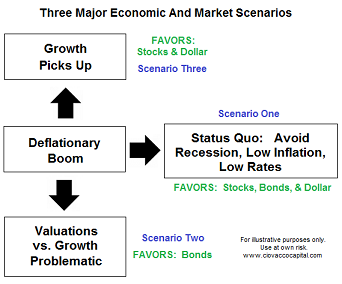

If XLE can clear the 82.10 to 84.62 barrier, and hold above that range, the odds will improve relative to “scenario three” as described in detail on January 27.

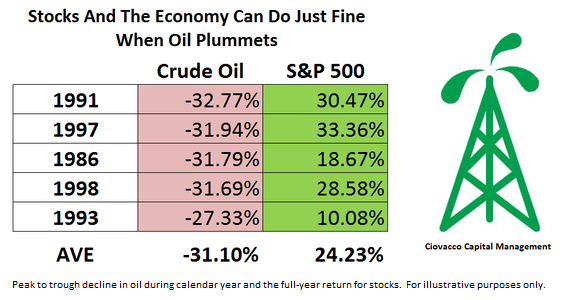

Myth: Stocks Can’t Do Well When Energy Is Weak

The point of the exercise is not to assess bullish and bearish odds for stocks, meaning stocks can go up within the context of a weak energy sector (see table below). The fate of energy stocks can assist us with the relative attractiveness of inflationary assets (e.g. energy) and deflationary assets (bonds).

Image from jinterwas via Flickr (image altered).

So what do you think?

Join the conversation instantly with Facebook Comments below:

This article is brought to you courtesy of Chris Ciovacco.

You are viewing a republication of Market Daily News content. You can find full Market Daily News articles on (www.marketdailynews.com)

Source: http://marketdailynews.com/2015/02/20/using-energy-to-gain-valuable-insight-on-stocks/