| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Gold COT Improving, But…

Gary Tanashian: Gold’s CoT data predictably improved again last week, but here I think some discussion is needed just in case it starts to get hyped too much.

Gary Tanashian: Gold’s CoT data predictably improved again last week, but here I think some discussion is needed just in case it starts to get hyped too much.

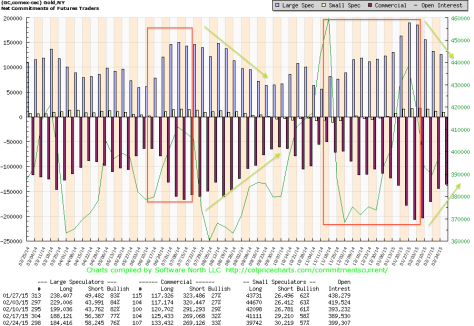

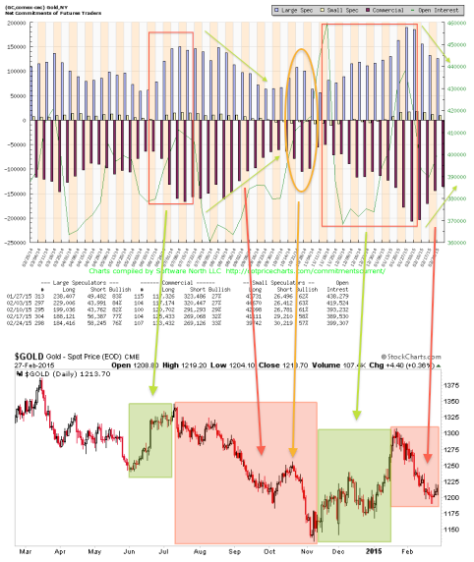

Below is the CoT on an improving trend of Commercial short covering and large Speculator long reduction. Okay, that’s good. But here is the part where the hype needs to be tuned out. The CoT tends to degrade (i.e. trend in a bearish direction during gold rallies) and improve (i.e. trend in a positive direction during gold corrections). The charts of CoT and gold below are set over the same 1 year time frames…

What I am saying is to watch out for a false blip, possibly coinciding with the festival of hopes and dreams known as PDAC. The sector can at times pump into and during PDAC and plunge after. Just so we are balanced here, it can also keep going up. It depends on the sector’s fundamentals at the time (still not fully baked) and the macro backdrop (in transition). But there is sure to be price movement into and out of PDAC.

Back on point, I don’t believe the improvement trend in the CoT is done yet. Hey great, it has more improvement ahead! But again, real turning points in the metal tend to come when CoT trends exhaust in the contrary direction. Here is a graphic of the above two items combined, showing a ‘blip’ in the CoT (orange) before its ultimate trend change with the November gold bottom.

Bottom Line

We are managing a fledgling gold sector rally coming right around the time of an event that brings out the gold “community” in numbers. There will be speeches and presentations that make a lot of sense to honest people in light of policy chicanery going on 24/7 and 365, globally. But price does not care about speeches. It cares only about what it is.

(…)Continue reading the original Market Daily News article: Gold COT Improving, But…

You are viewing a republication of Market Daily News content. You can find full Market Daily News articles on (www.marketdailynews.com)

Source: http://marketdailynews.com/2015/03/02/gold-cot-improving-but/