| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

How ZIRP Destroys The Economy

Many readers enjoyed the recent post of my song, ‘The ZIRP Song’. Songs like this resonate because they speak to what we know to be true, if we open our eyes. I think the message of the song deserves a fuller explanation. We need to understand the trends that cause ZIRP to be so destructive, so we can break those trends. To look for them, start by flipping on your radio.

Radio ads can be a good barometer of the true state of mind of a populace. This is especially true today. “The big banks got their bailout”, says one. “You can get yours”. “You have the right to have your debts settled for pennies on the dollar”, says another. Others proclaim “Rebuild your 401K”. “Buy and hold is dead”. ”The dollar is doomed. Buy Gold”. These ads now occupy a lot of radio and television airtime. They are a very visible sign of a trend – that owing money means nothing in our society today, and speculation is everything.

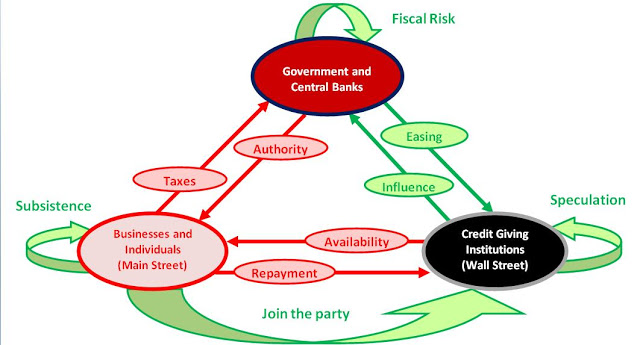

This very simple diagram illustrates why this is so. It shows the interplay between businesses and individuals (‘Main Street”), banks (‘Wall Street’), and the government and central banks, whom we consider as one for this discussion.

The Economy is Disappearing into a Black Hole

In the diagram, green represents behavior or revenues that increase, red represents decrease, and the arrows are feedback loops that develop as a result. The black represents the increasing gravity of a “black hole” that results. The reasons for these trends are easy to see by just using your common sense – no economic theory is required.

- The more easy money and easy debt that is created, the less the bond between creditor and debtor means. We get the moral hazard of bailouts and zero-interest policy, and everybody wants in. Owing money becomes meaningless. Society tries to convince you that you must maintain a good credit score, or that a lifetime of debt for a house is a good idea, but, increasingly, people see through it.

- Since credit is meaningless and bailouts/moral hazard are rampant, banks decrease lending, and turn to speculation. Why would banks lend when they are going to get stiffed anyway? How can we tell this? Just watch the asset bubbles grow and pop. Gold. Oil. Food. Housing. You name it.

- As speculation becomes the only way, banks collude with the government in order to protect their rice bowl. Cronyism is the result, as government goes easy on banks, gives them free money, and turns a blind eye to corruption. People conclude their government is “run by bankers“. Government’s authority decreases. Tax evasion increases. People who can, leave, or they find ways to shield their money.

- As people believe the system is rigged, they turn toward subsistence, taking less risk, trying to muddle through, or becoming dependent on handouts to survive. If they have the means, they will try to join the party by speculating themselves, in stocks, bonds, commodities, gold, etc. Or they may check out, and become preppers.

- Even in the presence of all this frenetic speculation, “Main Street” stagnates. The activity is not reaching them. They lose their jobs. They close their businesses. Panicked governments respond the only way they know how. They ease more, and print more, and the cycle continues.

Related posts:

- Great Song About How Bernanke And Obama Are Destroying Our Economy “The ZIRP Song” is simply and clearly about how the central…

- How Obama’s Hidden Tax Hike Destroys Your Savings by Floyd and Mary Beth Brown Americans are getting poorer,…

Read More and Comment: How ZIRP Destroys The Economy

2012-09-24 12:49:09

Source: http://www.exposeobama.com/2012/09/24/how-zirp-destroys-the-economy/

Source: