| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

The Mogambo Guru, “Home Again, and Hello Dante”

Saturday, March 25, 2017 8:17

% of readers think this story is Fact. Add your two cents.

“Home Again, and Hello Dante”, Introduction

by Charles Hugh Smith

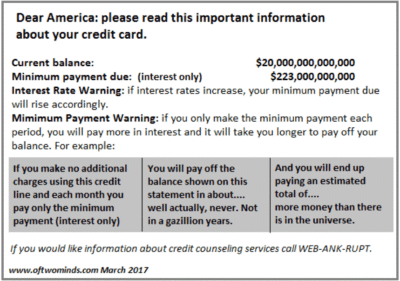

“What will replace the current system after it self-destructs? That’s the question. You know those disclosures on your credit card statements? That it will take 27 years to pay off your balance if you only make the minimum payment each month, and so on? You might not be aware of it, but America’s “credit card” – our national debt – comes with its own disclosure statement:

The only possible output of a system like this, lacking any discipline, is self-destruction. Whatever is free is squandered. When water is free, it’s freely wasted. When electricity is free, there’s no motivation to use it wisely.

The same principle holds true for money. If money is free, or nearly free, there is no motivation to invest it wisely, or to consider the opportunity costs of spending it versus investing it or preserving it as savings. Money that can be borrowed for next to nothing is essentially “free” because the costs of interest are negligible. Money that can be borrowed in virtually unlimited quantities is also “free,” as whatever funds are squandered or lost to malinvestment can be easily replaced with more borrowed money.

Nothing enduringly productive can be built without discipline and a steady focus on the bottom line of production costs, revenues, overhead expenses and opportunity costs, i.e., what else could have been done with this capital and labor.

All of which leads us to ask: What precisely have we accomplished by borrowing and blowing $9 trillion in additional national debt over the past eight years? With interest rates near zero and the credit line of the nation essentially unlimited – recall that the central bank created $3.5 trillion of money out of thin air and used much of it to buy federal bonds – there was no need for any difficult choices or trade-offs – that is, discipline.

Lowering interest rates to near zero has reduced the need for fiscal-political discipline to near zero. Politicos of all stripes are only too willing to borrow trillions from future generations – why not borrow and blow the money now to assure my re-election and let future taxpayers figure out what to do about the crushing burden of debt we’re leaving them?

High interest rates were basically the only mechanism of discipline imposed on short-term, free-spending politicos. Once the cost of interest was reduced to signal noise, politicos were freed of the burdens of discipline: of having to reckon the burdens of future interest, of opportunity costs, of trade-offs and the difference between productive investments and cronyist pork-barrel spending on marginal (but highly profitable) “infrastructure.”

How disciplined will your gambling be in the casino when all your losses are covered by future taxpayers?Why hold back from risky gambles when any losses will be paid by others? Go ’head and gamble wildly – any lucky wins will be yours to keep, and all the losses will be covered by nameless others.

This is how “free money” leads to disastrous decisions. With the need for discipline eliminated, there’s no motivation not to gamble wildly, fund every special interest group’s demand and grease the palms of every insider, every crony and every oligarch. This is how a great nation will self-destruct. The only possible output of a system lacking any discipline is self-destruction.

Below, the incomparable Mogambo Guru lays it all out for you – if you can stop from laughing. Read on.”

“Home Again, and Hello Dante”

By The Mogambo Guru

“Hey! Look! Here I am! Over here! I’m back! (Sound of thunderous applause). Thanks! Wonderful to be here!

I know that you, like most people, are probably scratching your head quizzically, asking yourself “Who is this doofus who calls himself Mighty Magnificent Mogambo in the next paragraph, which doesn’t even make sense? And who cares that he is back, which is not to mention why am I reading this stupid crap in the first freaking place?”

Or perhaps you are wondering “Where have you been all this lonely, lonely time, oh, Mighty Magnificent Mogambo (MMM), that you can now announce your triumphant return to the dispensing of wit and wonder about things such as, oh, I dunno, maybe, for example, how we are frantically screaming ‘We’re Freaking Doomed (WFD) because of all the absolutely INSANE amounts of money and the INSANE amounts of accompanying debt created by the evil Federal Reserve and all the other dirtbag central banks around the world’ all these many, many years?”

I am happy to answer your question, or to answer any question that is not “Do you always eat like a pig?” (Answer: no, not always).

The real answer is that I have been sort of sidelined, stupefied and stunned into some kind of “shock reaction” to heretofore unseen titanic seismic economic events concerning fiscal and monetary policy, the monstrous interplay of which I can only vaguely contemplate, but with a shudder.

It all started, as these things sometimes do, innocently enough. I was watching an episode of Gilligan’s Island (“Don’t pick those strange flowers, Gillian you idiot!”) to hopefully catch a scene with the adorable Mary Ann, while simultaneously reading Chuck Butler’s Daily Pfennig newsletter during the lulls in the action, like when there is nobody in the scene except Gilligan and the Skipper (“Listen to The Wise Mogambo (TWM) and don’t pick those strange flowers, Gillian you idiot!”).

Then, suddenly, out of nowhere, I was metaphorically slapped in the face (“Whack! Whack!”) by Mr. Butler when he revealed the alarming fact that the M2 Money Supply in 2000 was $4.673 trillion, and that today it is $13.386 trillion!

If my editorial use of an exclamation point in that last sentence did not serve to alarm you as it does other Junior Mogambo Rangers (JMRs) around the world and throughout the cosmos, then let me disabuse you of your laughable Pollyanna attitude by rudely pointing out that this is Something Really, Really Significant (SRRS)!

And the exclamation point is to, well, you know.

Anyway, then Mr. Butler, perhaps to make sure of our complete comprehension despite being already alerted by my clever and judicious use of exclamation points in the paragraphs above, goes on “imagine that if you will!”, which is a sentence fragment, replete with his exclamation point, that I lift wholesale so that one can be fully prepared to get to the following factoid that (drum roll, please) this is “a 186% increase in Money Supply here in the U.S. in 16 years.”

Yikes!

In case your blood has not immediately turned to a corrosive, ashy slurry congealing icily in your veins, I laboriously make the necessary calculations (by, first, tracking down some guy who remembers how to figure this stuff on an HP12C) only to discover, to my horror, that this means that the money supply has been increasing at 6.4 % per year! Yikes! Per Freaking Year (PFY)!

Yikes! Yikes!

Yet, yet, yet, this is when GDP growth has been less than a quarter that! Yikes! Yikes, Yikes! No wonder that the velocity of money has been slowing!

The screeching terror and disgusting flecks of spittle flying out of my mouth are easily explained by the simple, ugly fact that inflation in the money supply necessarily means inflation in prices!!!

By this time, you know what three exclamation points mean, I am sure.

And this is because it is inflation in prices that destroys economies; GDP falls when fewer and fewer people can afford discretionary spending, and economies crash when fewer and fewer people can afford to buy absolute necessities.

And how much debt has sprung from this poison fount of fiat currency? Egon von Greyerz of Matterhorn Asset Management AG writes that “global debt going from virtually zero one hundred years ago, to $230 trillion today. Within this astronomical figure is personal debt that cannot be repaid and government debt that will not be repaid. In addition there are unfunded liabilities and derivatives in the quadrillions.”

Quadrillions of dollars! At least two million billions of dollars! Or, if you prefer, two billion millions of dollars! Either way, a lot of moolah!

And with the GDP of The Whole Freaking World (TWFW) added together being somewhere around $80 trillion, the paltry lower figure of $230 trillion is (gulp!) almost 300% of GDP!

And, closer to home, let’s not forget about a towering $20 trillion national debt, or our massive $500 billion per year trade deficit, or the staggering $1.3 trillion in annual federal spending deficits!! More yikes, as handily indicated for your convenience by the use of two exclamation points!

And let’s not forget all about those three overpriced, highly-leveraged markets. Tens of trillions of dollars could be lost from these never-seen-before, nosebleed market valuations going down, and STILL be above real, long-term value! This means that everyone involved (which is you, me and everybody else with two dimes to rub together, whether they like it or not) is, or should be, absolutely fixated on making sure, sure, sure that nothing, nothing, nothing bad happens to the stock, bond and housing markets due to a pesky, yet easily-remedied, insufficient supply of new money with which to continually bid prices higher and higher.

And now we know why President Trump has surrounded himself with a lot of people associated with Goldman Sachs (“The vampire squid”) and the financial services industry, who have apparently always proven more than willing to do secret, slimy, corrupt things so that they reap the benefits of the inflation in asset prices, using money that the evil Federal Reserve creates, which causes the inflation in prices in the First Freaking Place (FFP)!

And with a fiat currency, a willing Congress and a complicit evil Federal Reserve making it all possible, it seems more and more obvious that Many, Many More Trillions Of Dollars (MMMTOD) will be created in the years ahead, and that things you buy are going to get much more expensive.

A Dow Jones Industrial Average of 30,000? Sure! 50,000? No problem! 100,000? Easy as pie! A $25 taco? Sure! A $50 taco? No problem! A $100 taco? Easy as pie!

So forget about picking those strange flowers, Gilligan! Make it easy on yourself, and go back to an earlier episode where you were mining gold and silver on that eponymous desert isle, finding huge nuggets which you were easily digging out of loose sand with a makeshift shovel made out of a lousy tortoise shell, for crying out loud.

And why? Because history has shown that the value of gold and silver always survive such monetary insanities, especially the insane Keynesian jibber-jabber that currently holds the world’s monetary system captive, and is directly responsible for the bankrupting mess we are in.

So, back to gold and silver, Gilligan. And maybe get that adorable Mary Ann to help you, perhaps prancing about as a delightful diversion from the ugly backdrop of a world descending into an economic hell about which not even Dante dared to write. Soon enough, you will be agreeing with me that “Whee! This investing stuff is easy AND pleasant!”

Source: http://coyoteprime-runningcauseicantfly.blogspot.com/2017/03/the-mogambo-guru-home-again-and-hello.html