| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

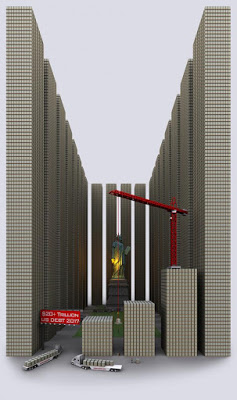

Visualizing The US Debt Ceiling (In $100 Bills)

Monday, March 6, 2017 5:13

% of readers think this story is Fact. Add your two cents.

“Visualizing The US Debt Ceiling (In $100 Bills)”

by Tyler Durden, Demonocracy

“The United States owes a lot of money. For now, there is no debt ceiling- it has been suspended- but in 10 days that changes, and who knows what happens then.

US Debt Ceiling – $20+ Trillion in 2017

Click image for larger size.

“$122,100,000,000,000. US unfunded liabilities by Dec 31, 2012.

Click image for larger size.

We have not upgraded the graphics for 2017 because it simply is pointless. The US government has no plan for fixing unfunded liabilities. This number is so far out there that it is incomprehensible to most readers but a few mathematicians.

Above you can see the pillar of cold hard $100 bills that dwarfs the WTC & Empire State Building- both at one point world’s tallest buildings. If you look carefully you can see the Statue of Liberty. The 122.1 Trillion dollar super-skyscraper wall is the amount of money the U.S. Government knows it does not have to fully fund the Medicare, Medicare Prescription Drug Program, Social Security, Military and civil servant pensions. It is the money USA knows it will not have to pay all its bills. If you live in USA this is also your personal credit card bill; you are responsible along with everyone else to pay this back. The citizens of USA created the U.S. Government to serve them, this is what the U.S. Government has done while serving The People. The unfunded liability is calculated on current tax and funding inputs, and future demographic shifts in US Population.

“It is incumbent on every generation to pay its own debts as it goes. A principle which if acted on would save one-half the wars of the world.” – Thomas Jefferson

“This is when you need to remember that when a nation’s economy collapses, the wealth of the nation doesn’t disappear, it only changes hands. Everyone needs to see this.”

Source: Federal Reserve & www.USdebtclock.org – visit it to see the debt in real time and get a better grasp of this amazing number.

◆

“Economist Laurence Kotlikoff: U.S. $222 Trillion in Debt”, Excerpt

“RealClearPolicy: Cox and Archer argue that the U.S.’s underlying debt is much higher than the officially stated debt of $16 trillion. They argue that if you add up the unfunded obligations the government has- to Social Security, Medicare, federal workers’ pensions, and so on- the real debt is about $87 trillion. Can that be right?

Kotlikoff: That’s wrong. It’s $222 trillion. That’s what we economists call the fiscal gap. I don’t know what those guys are looking at, but we economists do it a certain way. We’re not politicians. We’re just doing it the way our theory says to do it. What you have to do is look at the present value of all the expenditures now through the end of time. All projected expenditures, including servicing the official debt. And you subtract all the projected taxes. The present value of the difference is $222 trillion.

So the true size of our fiscal problem is $222 trillion, not $87 trillion. That’s comprehensive and incorporates the official debt. The official debt in the hands of the public is $11 trillion (in 2012 when this article was written- CP), so the true problem is 20 times bigger than the official debt.

The official debt is something that has to be repaid, and the government is committed to principal and interest payments. But the government has other commitments, like Social Security payments, health care and Medicare payments, Medicaid payments, and defense expenditures. And it also has negative commitments, namely taxes. So you want to put everything on even footing. Most of the liabilities the government has incurred in the postwar period have been kept off the books because of the way we’ve labeled our receipts and payments. The government has gone out of its way to run up a Ponzi scheme and keep evidence of that off the books by using language to make it appear that we have a small debt.”

Full article is here: - http://www.realclearpolicy.com/

◆

And soon cometh March 15, and just what do you think will happen then, Good Citizen? Yes, “everyone needs to see this”… and do WHAT? It’s a good thing the main stream news and the government are, as always, keeping you fully and truthfully informed, all the headlines and coverage, right? Right? Oh…

- CP

Source: http://coyoteprime-runningcauseicantfly.blogspot.com/2017/03/visualizing-us-debt-ceiling-in-100-bills.html