| Online: | |

| Visits: | |

| Stories: |

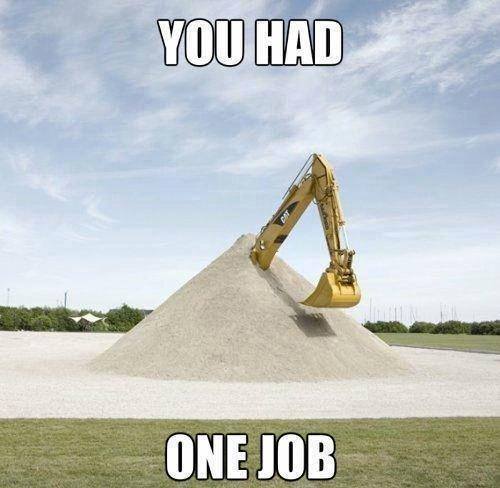

You’re doing it wrong…

(A contingent beneficiary is one who would receive the proceeds if the primary pre-deceased the insured)

About 4 years ago, Bruce Sr died, and his estate settled by his widow, Susie, who then passed away. Very sad, but that’s how life goes.

Now Bruce Jr has passed away.

Quick: who gets the insurance money?

I must admit to a bit of surprise here: according to the carrier, the son’s estate would get the proceeds. This makes no sense to me: he was merely the insured, with no ownership or beneficiary rights.

Here’s another way of looking at this: suppose I bought an insurance policy on my mechanic (assume I could show insurable interest), naming myself as the sole beneficiary. He makes no premium payments, has no rights rights in the policy. I pass away. Why would his widow (or children) have any claim on the proceeds?

Weird.

The primary lesson here is that periodically reviewing your insurance policies – particularly the beneficiaries thereof – is a good idea.

Source: http://insureblog.blogspot.com/2015/03/youre-doing-it-wrong.html