| Online: | |

| Visits: | |

| Stories: |

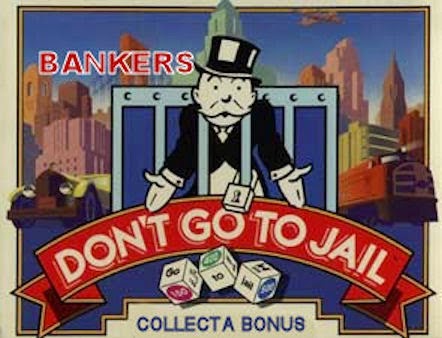

Where's the jail-time for the banksters?

Saturday, April 25, 2015 19:07

% of readers think this story is Fact. Add your two cents.

Authorities announced that Germany's biggest bank, Deutsche Bank would pay $2.5 billion in penalties, a record for cases involving interest rate fraud, which have already targeted banking behemoths like Barclays and UBS. Officials said the wrongdoing at Deutsche Bank lasted from 2005 to 2011 and touched employees in London, Frankfurt, New York, and Tokyo.

The New York Times reports that Deutsche Bank “also agreed to accept a criminal guilty plea for the British subsidiary at the center of the case. It is the most significant banking unit to accept a criminal plea in the long-running investigation into the manipulation of the London interbank offered rate, or LIBOR.” The LIBOR rate is an average of what banks charge for lending to each other. In addition, it sets a benchmark for interest rates for trillions of dollars' worth of loans around the world—from mortgages and student loans to credit cards and complex derivatives. The penalty follows a seven-year investigation into how some of the world's largest financial institutions secretly conspired to rig benchmark interest rates to their benefit.

“Law enforcers found repeated examples of manipulation as they investigated the bank,” said Bartlett Naylor, financial policy advocate in Public Citizen's Congress Watch Division “For example, they discovered pervasive fraudulent practices where traders gave false information about rates at which they borrowed or loaned money with other banks,” he said. “That established false benchmarks on which other rates were based. That harms average Americans when they agree to mortgages. Law enforcers also found that Deutsche Bank withheld and even destroyed information about the investigation. Yet, surprisingly, despite the severity of these offenses, the government concluded that these crimes should be punished only through a financial penalty.”

Many of the traders responsible for the frauds remain employed at Deutsche Bank. Insider trading in individual stocks seems minute in comparison, yet many people have been jailed for 10 years or more. The case spotlighted the collusive elements of Wall Street trading desks, where rival banks have occasionally joined forces to manipulate financial benchmarks. It also foreshadows looming actions against banks suspected of teaming up to manipulate the price of foreign currencies

“I have no country to fight for; my country is the Earth, and I am a citizen of the World.” – Eugene V. Debs

Source: http://mailstrom.blogspot.com/2015/04/wheres-jail-time-for-banksters.html