| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

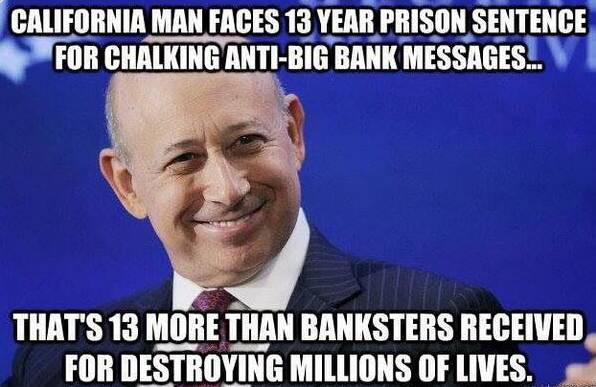

If ‘Too-Big-to-Fail’’ Means Too-Big-To-Jail’ It Should Mean ‘Too-Big-to-Be’

Dave Lindorff

In a couple of days, the so-called US Justice Department will be announcing an “agreement” reached with five large banks, including two of the largest in the US — JP Morgan Chase and Citigroup, the holding companies for Chase and Citibank — under which these banks or bank holding companies will plead guilty to felonies involving the manipulation of international currency markets.

This is not really a plea deal, or what in the lingo of criminals is called “copping a plea.” It’s a negotiation in which the nation’s top law-enforcement organization — the one that just sentenced a teenager to death in Boston in the Marathon bombing case, and that routinely sends ordinary people “up the river” for minor drug offenses or even tax fraud — is taking seriously these banks’ concerns that if they plead guilty to felonies they might be barred by SEC rules from engaging in many profitable practices. So — get this — the Justice Department is seeking assurances from the commissioners of the Securities and Exchange Commission that they will not enforce those rules against these particular felonious banks.

There will be fines, of course, though nothing that will even dent the profits of these megabanks, which also include two British-based institutions, Barclays and the Royal Bank of Scotland, as well as the Swiss-based bank UBS. But under these deals, not one bank executive will even be forced to quit his post, much less face jail time or even a fine. As the New York Times put it in an article last Thursday, “In reality, those accommodations render the plea deals, at least in part, an exercise in stagecraft.”

What this means is that the departure of bankers’ friend Eric Holder as Attorney General, and his replacement by Loretta Lynch, has not changed the policy announced by Holder several years back that there would be no prosecutions of the leaders of the so-called “too-big-to-fail” banks for the scandals and crimes that collapsed the US and the global economies in 2008, bringing on the so-called Great Recession that is still punishing the people of the US and many other countries. In fact it demonstrates that there will be no real prosecution of wrongdoing by these monolithic banks for crimes committed since the financial crisis either and going forward.

A news collective, founded as a blog in 2004, covering war, politics, environment, economy, culture and all the madness

Source: http://thiscantbehappening.net/node/2759