| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Understanding Bitcoin: It’s a Virtual Commodity, Not Money

No doubt, you have heard of Bitcoin. But do you know what it is? Many reflexively respond that it is a ‘ponzi scheme’ while others see it as a form of currency. While the latter might seem to be a reasonable description, neither is true.

No doubt, you have heard of Bitcoin. But do you know what it is? Many reflexively respond that it is a ‘ponzi scheme’ while others see it as a form of currency. While the latter might seem to be a reasonable description, neither is true.

Sadly, the creator of Bitcoin chose a name which misleads from the very start.

Bitcoin is considered a class of ‘Cryptocurrency’, yet is not treated as such in the eyes of the U.S. government.

How is this possible?

The simple answer is that if a sovereign government doesn’t sponsor minting of such technology as a currency exchange method, then it can’t be used as such and is deemed illegal to do so.

So how is Bitcoin being used?: as a Virtual Commodity.

“Okay”, you say, “Now I am more confused.”

Alright. Let’s take a look at some of gold’s properties:

- Gold, silver, wheat, soy beans, oil, etc. are all traded through commodity exchanges.

- Gold is inert and will not oxidize as other metals like iron or copper will.

- Gold is a ‘store of value’.

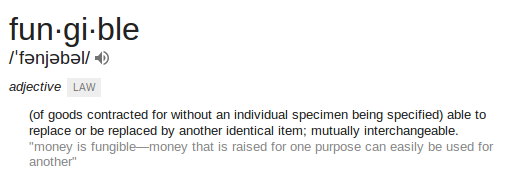

- Gold is fungible. Here is a definition for fungibility:

“So what?”, you say.

Bitcoin is all of the above!

Forward looking innovative companies like Coinbase are taking the lead in adopting Bitcoin as another payment class for on-line Internet Web Merchant transactions.

Forward looking innovative companies like Coinbase are taking the lead in adopting Bitcoin as another payment class for on-line Internet Web Merchant transactions.

“Sigh………….”

“Alright, tell me how.”

Coinbase is an on-line web commodities broker of Bitcoin. Being a commodites broker, they buy and sell Bitcoin (as though it were gold) and they follow the same regulatory law that other commodity brokers must adhere to. This keeps the U.S. government happy, since they aren’t treating Bitcoin as a ‘currency’.

#facepalm “Now, I have a headache.”

“So, if Bitcoin can be used for making payments on the Internet, why isn’t it a currency!? (sheesh)”

Ah, bear with me. We’re getting to the point now.

One can buy any commodity through a registered broker, yes?

“Yes….” (taps fingers)

Coinbase facilitates your buying Bitcoin with a credit card or a bank transfer into your Coinbase account.

Let’s say, you decide to create a Coinbase account with the purchase of one Bitcoin. At today’s rate one Bitcoin is worth around $260.00

So in Coinbase you transfer $260 from your bank account and purchase 1 Bitcoin. All well and good.

“Then what?” (rolls eyes)

Coinbase acts as an ‘intermediary’ with thousands of participating on-line web merchants. The process for making payments includes a Bitcoin option. Selecting Bitcoin as the payment method will transparently withdraw a quantity of Bitcoin from your Coinbase account and sell it to the broker who keeps the Bitcoin and pays the Merchant! Cash is used to make the payment. The broker has followed regulatory commodity exchange law. The merchant is happy they don’t have to protect your secret credit card information from theft and have received payment in cash! The U.S. government is happy that Bitcoin isn’t being used as currency.

The process for making Bitcoin payment is safer than using credit cards as no personal information is exchanged with the merchant and Coinbase is acting on your behalf.

Coinbase keeps your Bitcoin wallet safe using best of breed methods like ‘cold storage’. No theft can occur.

I hope this explanation helps the reader better understand Bitcoin. It has a big bright future.

– Dietrich

__________________________________________________________________

(The author of this story has no afiliation with Coinbase or Bitcoin.)

and it’s dropping in value like a dead cow….

At least it’s not a dead cat bounce. Seriously, commodities do often fluctuate and when ‘incidents’ like problems at Bitstamp or the Fed auctioning off part of their bitcoin stash happen, there will be corresponding dips from which we have seen recovery.

Seriously, commodities do often fluctuate and when ‘incidents’ like problems at Bitstamp or the Fed auctioning off part of their bitcoin stash happen, there will be corresponding dips from which we have seen recovery.

Expect bitcoin to behave in similar fashion to gold (inverse) when the U.S. dollar either collapses or is intentionally devalued as has been rumored will happen when a new Treasury issued Dollar note is rolled out (to replace the Federal Reserve Dollar note).