| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Economic Collapse Is Predicted – Massive 78% U.S. Depopulation

Economic Collapse Is Predicted

So what exactly is an “Economic Collapse”?

In proper context, it would be a complete breakdown of our national and regional (more than likely global) economies. It is basically a severe economic depression, where an economy is in complete distress for years or possibly even decades.

The Great Depression is a decent example of an economic collapse. In 1929, the stock market crashed after amazing growth (and manipulation) and it destroyed the economy. This brought about unemployment to the tune of 24% – possibly 25%, high levels of poverty and it lasted for many years.

You can always pin-point an economic collapse by a few specific factors. These events are characterized by extremely high unemployment, excessively high poverty levels, and bouts of civil unrest. The scary element of this is the fact that desperate people do desperate things.

Causes of these events range from market manipulation, hyperinflation, deflation, bubbles bursting, stagflation and basic financial-market crashes.

Of course, these headings have their own extensive lists of causing factors such as out of control debt and currency devaluation. Sometimes, a simple drop in consumer confidence can get the ball rolling.

Of course, we are already witnessing much of this and anyone paying even the slightest bit of attention has undoubtedly heard these terms as of late.

There are some that believe that government intervention may be necessary to bring an economy back from collapse.

Some believe that government intervention is the last thing that should be done. Still, some believe that an economic upheaval is only corrected after the war that inevitably follows.

After the Great Depression for example, the government created many programs building roads, buildings, bridges, etc., to get people working while also building national infrastructure. Did this fix the economy?

What we know for sure is that it brought about substantially larger government in the end, which in many ways just perpetuated the cycle. Then what happened? World War II and the end of the Depression. Maybe they are all right.

As A Way To Introduce You To Skilled Survival, We’re Giving Away Our ‘Family First’ Food Planning Guide. Click Here To Get Your Copy.

The collapse of the Western financial system will wipe out the standard of living of its population while ending ponzi schemes such as the stock exchange and the pension funds.

The population will be hit so badly by a full array of bubbles and ponzi schemes that the migration engine will start to work in reverse accelerating itself due to ripple effects thus leading to the demise of the States.

This unseen situation for the States will develop itself in a cascade pattern with unprecedented and devastating effects for the economy. Jobs offshoring will surely end with many American Corporations relocating overseas thus becoming foreign Corporations!!!!

We see a significant part of the American population migrating to Latin America and Asia while migration to Europe – suffering a similar illness – won’t be relevant. Nevertheless the death toll will be horrible.

Take into account that the Soviet Union’s population was poorer than the Americans nowadays or even then. The ex-Soviets suffered during the following struggle in the 1990s with a significant death toll and the loss of national pride.

Might we say “Twice the pride, double the fall”? Nope. The American standard of living is one of the highest, far more than double of the Soviets while having added a services economy that will be gone along with the financial system. When pensioners see their retirement disappear in front of their eyes and there are no servicing jobs you can imagine what is going to happen next.

At least younger people can migrate. Never in human history were so many elders among the population. In past centuries people were lucky to get to their 30s or 40s. The American downfall is set to be far worse than the Soviet Union’s one. A confluence of crisis with a devastating result…(source)

Fema Camps & DePopulation Plans from the ELITE to Control the Masses

The following are 11 predictions of economic disaster from top experts all over the globe…

#1 Bill Fleckenstein: “They are trying to make the stock market go up and drag the economy along with it. It’s not going to work. There’s going to be a big accident. When people realize that it’s all a charade, the dollar will tank, the stock market will tank, and hopefully bond markets will tank. Gold will rally in that period of time because it’s done what it’s done because people have assumed complete infallibility on the part of the central bankers.”

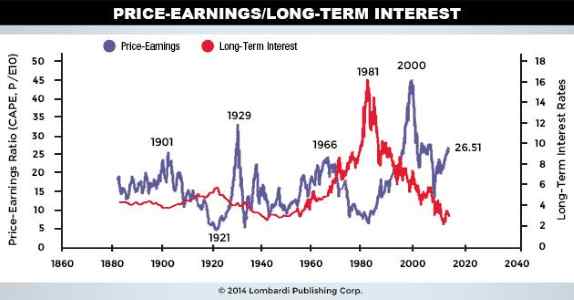

#2 John Ficenec: “In the US, Professor Robert Shiller’s cyclically adjusted price earnings ratio – or Shiller CAPE – for the S&P 500 is currently at 27.2, some 64pc above the historic average of 16.6. On only three occasions since 1882 has it been higher – in 1929, 2000 and 2007.”

#3 Ambrose Evans-Pritchard, one of the most respected economic journalists on the entire planet: “The eurozone will be in deflation by February, forlornly trying to ignite its damp wood by rubbing stones. Real interest rates will ratchet higher. The debt load will continue to rise at a faster pace than nominal GDP across Club Med. The region will sink deeper into a compound interest trap.”

#4 The Jerome Levy Forecasting Center, which correctly predicted the bursting of the subprime mortgage bubble in 2007: “Clearly the direction of most of the recent global economic news suggests movement toward a 2017 downturn.”

#5 Paul Craig Roberts: “At any time the Western house of cards could collapse. It (the financial system) is a house of cards. There are no economic fundamentals that support stock prices — the Dow Jones. There are no economic fundamentals that support the strong dollar…”

#6 David Tice: “I have the same kind of feel in ’98 and ’99; also ’05 and ’06. This is going to end badly. I have every confidence in the world.”

#7 Liz Capo McCormick and Susanne Walker: “Get ready for a disastrous year for U.S. government bonds. That’s the message forecasters on Wall Street are sending.”

#8 Phoenix Capital Research: “Just about everything will be hit as well. Most of the ‘recovery’ of the last five years has been fueled by cheap borrowed Dollars. Now that the US Dollar has broken out of a multi-year range, you’re going to see more and more ‘risk assets’ (read: projects or investments fueled by borrowed Dollars) blow up. Oil is just the beginning, not a standalone story.

If things really pick up steam, there’s over $9 TRILLION worth of potential explosions waiting in the wings. Imagine if the entire economies of both Germany and Japan exploded and you’ve got a decent idea of the size of the potential impact on the financial system.”

#9 Rob Kirby: “What this breakdown in the crude oil price is going to spawn another financial crisis. It will be tied to the junk debt that has been issued to finance the shale oil plays in North America. It is reported to be in the area of half a trillion dollars worth of junk debt that is held largely on the books of large financial institutions in the western world. When these bonds start to fail, they will jeopardize the future of these financial institutions. I do believe that will be the signal for the Fed to come riding to the rescue with QE4. I also think QE4 is likely going to be accompanied by bank bail-ins because we all know all western world countries have adopted bail-in legislation in their most recent budgets. The financial elites are engineering the excuse for their next round of money printing . . . and they will be confiscating money out of savings accounts and pension accounts. That’s what I think is coming in the very near future.”

#10 John Ing: “The 2008 collapse was just a dress rehearsal compared to what the world is going to face this time around. This time we have governments which are even more highly leveraged than the private sector was.

So this time the collapse will be on a scale that is many magnitudes greater than what the world witnessed in 2008.”

#11 Gerald Celente: “What does the word confidence mean? Break it down. In this case confidence = con men and con game. That’s all it is. So people will lose confidence in the con men because they have already shown their cards. It’s a Ponzi scheme. So the con game is running out and they don’t have any more cards to play.

What are they going to do? They can’t raise interest rates. We saw what happened in the beginning of December when the equity markets started to unravel. So it will be a loss of confidence in the con game and the con game is soon coming to an end. That is when you are going to see panic on Wall Street and around the world.”(source)

But it’s not just a US problem. This thing is global, which further complicates the picture and darkens up the effect. To break this down as simple as I can, global debt has risen a massive $57 trillion (more than 25%) since the crisis of 2008.

It’s getting worse for a lot of different reasons, but also because of the nation’s now trying their hand at their own QE – Quantitative Easing – schemes. The point is that there is little (if any) real evidence to suggest that things are getting better. In fact, just the opposite is true.

It has been said that the United States and Europe overall, are in a debt-fueled deflation which is spiraling out of control. And with interest rates at next to nothing, it means there is little (if any) room left to wiggle.

Now factor in the drastic reduction in retail sales and the dramatic reduction in manufacturing and exports out of China, we begin to see a much bigger and darker picture. Things are slowing down at a dramatic pace. Of course, this affects China substantially and they are seeing the signs as well –and preparing.

The Lost Ways is a comprehensive book that teaches you a variety of ways that our forefathers used to deal with different situations. The program teaches you survival mechanisms that does not require money. The fact is that the modern survival equipment is unreliable and ineffective. In fact with the techniques in this book, you can survive solely in a catastrophe that kills everybody.

SOURCE : http://www.mydailyinformer.com/economic-collapse-is-predicted-massive-78-u-s-depopulation/

does not take a genius to figure out one thing,and one thing only–debt–it will cause everything to fail–too much debt–its everywhere-but the usual way govnrmints deal with a problem is war–so get ready-2 years max,maybe,or maybe tomorrow!

They use war as a distraction to deflect from domestic economic failures and evilly use the military industrial complex as a way to jump start the economy. Not only is it a very short term solution, it kills thousands/millions based on wars started with false flags/hoaxes, and adds massive amounts of debt to all the tax payers for current and future generations.

It shouldn’t take a rocket scientist to figure out wars solve nothing. People need to demand an end to predatory crony capitalism and a return to sound economic growth.

All the big winners in the 2008 crash said it will happen again at Dow 22000.

Oh the sky is falling because we are in a deflationary cycle. Really, I haven’t seen the price of bread come down have you?

You will need FOOD.

ALL survival will work around FOOD.

Free soul doesn’t limit itself to office space.

The article is a brainwash stuff, sort of waste of time reading it….

After removing a stumbling block in perception caused by nephilim brainwash/hogwash, you may notice the correct picture where nobody is indebted to nobody else.

Audrey Tomason from Obama’s regime had a college thesis called the Apocalypse Equation which was classified as TOP SECRET. As an ‘intellectual exercise’ I published “The Apocalypse Theorem” to see if I could twist my mind enough to promote a 95% population reduction. The Georgia Guidestones also promote this. Obama had eight years to set this plan in action and it’s probably on ‘auto-pilot. Have you heard anything about the ‘elites’ building bunkers?

The stock market has absolutely NOTHING to do with the America economy, the stock market is just another form of legalized gambling ~ plain & simple…

Our economy surreptitiously transitioned from manufacturing to the petro dollar scheme over the decades. We import more than we export. The value of the dollar is now based on how many countries are willing to sell their natural resources in dollars, hence the value of the dollar is purely psychological psychobabble. It does not have roots like it did in the 50s, 60s, 70s.

Stock market bubbles everywhere with repackaged debt schemes(derivatives), pie in the sky price earning ratios, unrealistically high demands of capital investment returns, investment banking which is a merger of lending institutions with speculation tools, no tariffs on imports, too much progressive regulation in terms of fake environmentalism and inflationary wages promoted by unions and minimum wage laws, mandatory healthcare which is devaluing the industry/creating monopolies/introducing massive inflation, etc.

Basically big government creating problems everywhere and failing to solve anything. We need a Reagan on steroids and I don’t think trump is that. Massive deregulation so the markets can sort everything out on their own. Sure there will be a big hurt in the process for some people, but encouraging more government interference of the wrong kind will only magnify the depression in the long run when it does happen.

Michael,

According to God’s prophet Ezekiel one third will die of famine and disease and one third by war and the remaining third will be taken into captivity – but by the end of 3 1/2 years only 10 % of the beginning number will survive.

God’s prophets all state the 1/3 taken into captivity are shipped around the world to gentile nations as Slave labor/.

They will be shipped to Germany, Egypt, China and some to all the other smaller gentile nations

I’m no financial or economy expert by any stretch of the imagination. What I do have though is an abundance of common sense plus a few years of life experiences under my belt. Without a doubt – the entire global financial system is teetering on the abyss. How much longer this illusion can be held up is really anyone’s guess. Now that we have President Trump and the shadow government and other worthless bureaucrats who can’t stand him – they will do NOTHING to support or help him and will do everything within their own power to bring him down. If that means bringing down the entire global financial system – then so be it. The system is in it’s own death throes as it is – it won’t take much to kill it.

Those that sale gold to consumers have for over three years been predicting “any day” that the dollar and the Dow will collapse, credit freezes, supply chain disruptions, all markets are manipulated and of course metals are going to the moon. It is fear porn and this is how they market metals to the consumer. Most of these people have no experience trading in the financial markets so they do not understand what causes price movement.

International capital flows have steadily been moving into the dollar and the Dow for over a year especially from Europe as the euro and the EU collapses. Capital has been being pulled from banks there causing liquidity problems. If you control large amounts of capital are you really going to park it in a collapsing currency and banks with liquidity problems? This capital needs markets where there are large pools of liquidity and that is here in the US.

The sovereign bond crisis has started again in the EU with yields spiking. Capital has started to rotate out of these and going into dollar based assets. This will accelerate thru 2017 and 18. Just a few days ago even German bunds spiked as capital was rotated out. Investors in Europe have finally woken up to the fact Germany is in serious trouble with the Target 2 settlement mechanisms and will never be repaid by other EU countries as most are insolvent.

With bunds spiking what do you think the dollar and Dow did? The dollar strengthened over the 1002 level and the Dow hit a another record all due to these international capital flows.

These capital will keep markets up in the US until at least 2020 and then that is when the US starts it decent downward as the crisis in Europe will finally hit here. This will last from 2020 accelerate and last until 2032 in which the US will be forced to break into 5 different regions as there will be no capital to run the US government, social security, food stamps or the military.

All this has been forecast by 5 computer models that track international capital flows and with it social change that always occurs when capital is removed from a country. These models have forecast the 87 crash, dot com bust, 2008/9 crisis and housing bust, the Brexit outcome on the very day it happened, the Dow and dollar strength for over a year now, weakness in gold, a Trump victory, the collapse of the euro and the EU and of course the future collapse of the US. The new financial and power centers in the very near future are Asia led by China and the Eurasia Trade block led by Russia with China heavily involved!