| Online: | |

| Visits: | |

| Stories: |

Is Greece's Fate a Harbinger of Our Own?

Saturday, July 18, 2015 6:46

% of readers think this story is Fact. Add your two cents.

The Masonic Jewish central bankers plan to deprive all nations of their sovereignty

using “debt” as a pretext. Greece, the birthplace of democracy, is a test case.

by Henry Makow Ph.D.

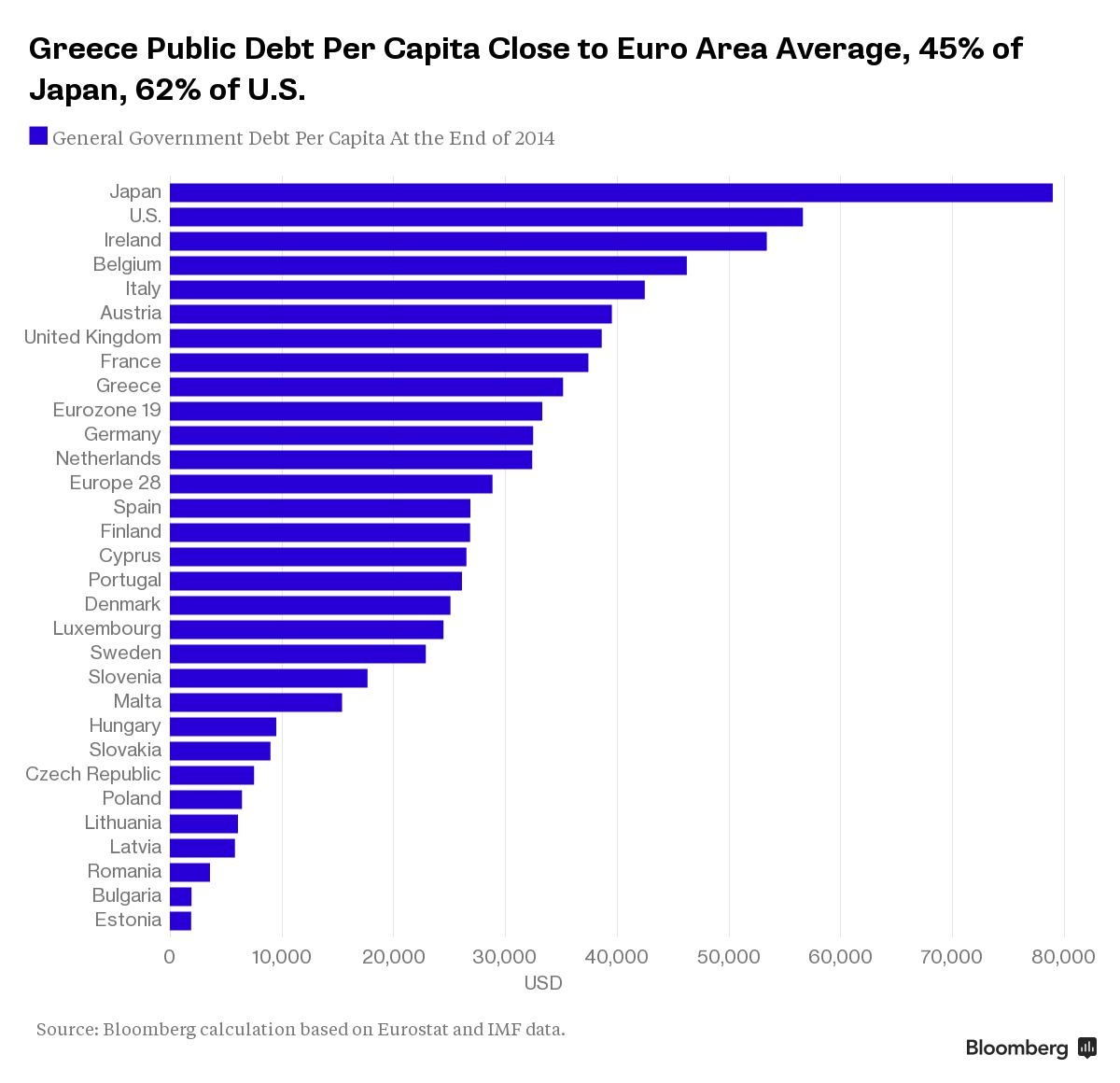

I was surprised to read that America’s per capita debt is 50% higher than Greece’s. Greeks owe about $35,000 per person while Americans owe $57,000. In fact, as the chart below indicates, the Greek per capita debt is close to the Eurozone average, and almost the same as Germany at $34,000.

The difference of course is their capacity to carry this debt. The Greek debt is 200% of the Gross Domestic Product. In 2013, United States public debt-to-GDP ratio was 71.8%, or 104.5% including external debt. The level of public debt was 76.9% of GDP in Germany, 22.4% in China, 66.7% in India, 86% in Canada, 87.2% in the UK, 92.2% in France, 94% in Spain, 124% in Ireland and 127.9% in Italy.

Obviously all nations are vulnerable to the Greek treatment if there were an economic crisis that affected the GDP.

THE GREEK PLOT

In 2008, our Hungarian correspondent sent the following information which is starting to look prescient.

“A friend of mine who is a now a disillusioned high ranking member of the Jewish Freemasonry in Budapest has told me what is coming regarding the Greek crisis. Greece was chosen to play the role of the European Union bankrupt member state in order to “create” the big problem to which the European Union is going to “find” the “solution” soon…

The “only solution” soon to be proposed soon by the EU is to suppress the national fiscal and budgetary policies in Europe and have a centralized European budget. All European states will have to send most of their tax money to a central European government and the national budgets will be established by this central government too… it will mean that the European national governments will cease to exist.”

WHAT’S IN STORE

The Greek deal offers a glimpse at what may be in store for us.

1. Pillaging our assets and resources. Up to €50bn (£35bn) worth of Greek assets will be transferred to a new fund, which will contribute to the recapitalization of the country’s banks.

The “valuable assets” include things such as planes, airports, infrastructure and banks.

2. Reform of retirement age, pensions and increase of VAT to 23%.

3. Automatic spending cuts if targets aren’t met.

4. EU officials in all ministries overseeing spending.

5. The new deal also calls for “more ambitious product market reforms” that will include liberalizing the economy with measures ranging from bringing in Sunday trading hours to opening up closed professions. Athens must “undertake rigorous reviews and modernization” of collective bargaining and industrial action.

6. Greece has been told to get on with privatizing its energy transmission network operator (ADMIE).

CONCLUSION

Ellen Brown has pointed out that the ECB could relieve the Greek debt by creating money. They are creating 60 billion euro every months as part of their qualitative easing program. Greek debt relief would amount to just one month.

But the goal of the central bank is not to solve Greece’s problems but to exploit them in order to pillage the country. These bankers have been doing this for centuries. When they create money out of nothing, it returns to nothing when it is repaid. The banker prefers that countries default so they can get hard assets for their imaginary loan.

Our per capita debt is nearly the same or greater than Greece’s. If our economies falter, the bankers will be at our door demanding their pound of flesh, and what little remains of our sovereignty.

Source: http://henrymakow.com/2015/07/is-greece-fate-a-harbinger.html